Extreme flood insurance rate hikes and inaccurate floodplain maps drive up the cost of homeownership and threaten small businesses, the nation’s home builders told Congress in a hearing on June 30.

Randy Noel, second vice chairman of the National Association of Home Builders (NAHB) and a home builder from LaPlace, La., told the Senate Committee on Small Business and Entrepreneurship that the NAHB has long supported practical, commonsense changes to the National Flood Insurance Program (NFIP).

“However, as Congress works to reauthorize the NFIP program by the September 2017 deadline, it must guard against the exorbitant rate hikes and faulty flood-plain delineations that have plagued the program in the past,” Noel said.

In 2012, with the NFIP facing insolvency, Congress enacted the Biggert-Waters Flood Insurance Reform Act to ensure the program’s fiscal soundness. Unintended consequences from the legislation caused significant problems for homeowners and prospective homebuyers by triggering an immediate shift to full-risk rates phased in over four years.

“Home builders live and work in their communities. We see the effects of flood insurance rate increases in our personal and professional lives,” Noel added. “One Louisiana buyer bought a home only to realize the flood insurance rates had increased from $400 annually to the full-risk rate of over $13,000.”

Flood insurance rate increases also have a direct impact on home builders. The rates make it much more difficult for owners of older properties to sell their homes and “move up” to a newly constructed home that is more resilient and built to higher construction standards. This puts local builders’ businesses in jeopardy and also constrains the local economy, Noel said.

Kevin Robles, a home builder from Tampa Bay, Fla., told the committee that housing prices in Florida are still 22 percent below normal due to the Great Recession.

Robles added that in Florida, where there are large Special Flood Hazard Areas, it is extremely difficult to avoid building in or near a flood plain, so inaccurate flood plain maps are problematic. It can cost hundreds of thousands of dollars to change the flood maps or to elevate a property.

Housing Market Snapshot

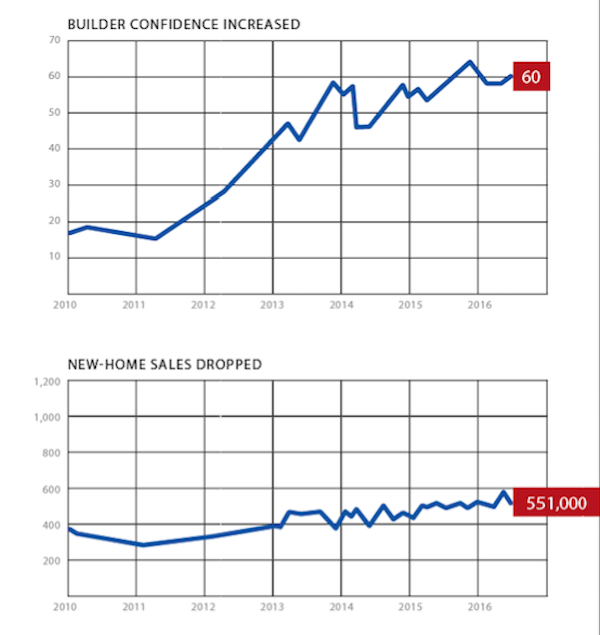

According to the NAHB/Wells Fargo Housing Index, builder confidence increased in June to 60. May new-home sales dropped 6 percent from April to an annual rate of 551,000, and housing starts also fell 0.3 percent during the same period to an annual rate of 1.16 million. Remodeling spending in May grew 1.4 percent to $151.2 billion.

Advertisement

Related Stories

Labor + Trade Relations

Who's Earning What in Construction

Workers in construction management roles may earn a higher median wage, but on average, lower-paid occupations have experienced somewhat faster wage growth

Build to Rent

Build-to-Rent Is Booming, Particularly in These Metros

A recent report finds that the Phoenix metro leads with more than 4,000 build-to-rent units completed in 2023, and Texas is the leading state for build-to-rent development

Sustainability

Which Green Building Practices Are Home Builders Using Most?

A recent report reveals which green-building practices are most popular among single-family home builders and remodelers