Since the mid-1950s, business guru Peter Drucker has often reminded us that we can’t manage or improve what has not been measured. W. Edwards Deming cautioned us to that effect, too, warning that in the absence of statistics, all you have is an opinion. This wisdom leads to an important truth in the management of new-home sales: There exists a number that is critical to know, and it’s your breakeven point. Without this figure, it’s pretty much impossible to create accurate and meaningful sales projections.

Understanding Your Breakeven Point

The breakeven point—the figure that represents the number of closings needed until your fixed overhead is covered—is essential, and it’s a revenue milestone for any business. For each home closing beyond your breakeven point, there’s a significant incremental contribution to the bottom line.

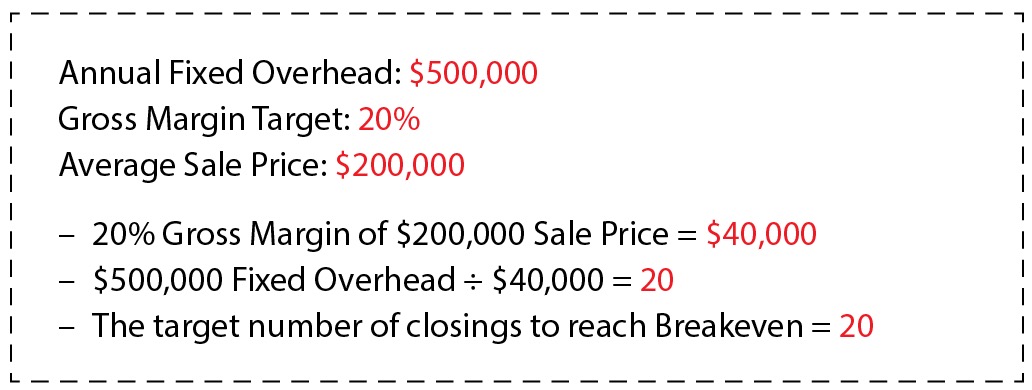

There are various ways of determining a breakeven point. In its simplest form, it’s a mathematical analysis that starts with overhead, or the fixed operating costs to run the company; estimated gross margin target; and the average sales price to determine the number of homes to be sold and closed to reach breakeven.

1. Consider this hypothetical:

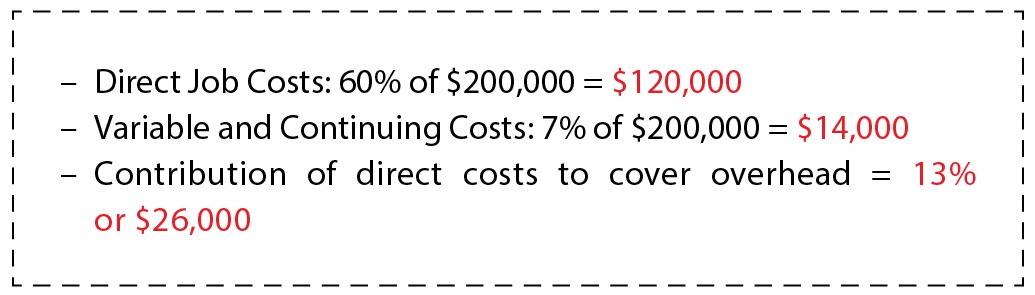

2. Next, factor in the direct job costs up to the breakeven point (land, bricks, sticks, and all that it takes to build the home to completion) and the variable and continuing costs beyond the breakeven point (sales commissions and concessions, construction loan interest, marketing and advertising) as a percentage of the average cumulative sales price. A hypothetical:

In this example, the breakeven point is reached at 20 new-home closings. Each closing beyond that contributes approximately $26,000 of additional incremental revenue directly to the bottom line profit. Getting to the breakeven number sooner than later is the objective of profit-focused sales management.

Sales Managers, Start Your Engines

Knowing your breakeven number is the key to winning projections, and once it’s been met, the race begins. For builders that have more than one community or specific project, the overall breakeven number, once identified, will be allocated to each project based on market conditions, pricing, and other related factors. To progress efficiently toward that crucial bottom-line milestone, sales managers should keep these tenets in mind:

Don’t overpay for underperformance. Build a sales compensation model targeted to sales production that reaches the breakeven point sooner rather than later and that escalates as higher profit levels are achieved. This prevents salespeople from reaching their financial comfort zone by selling fewer homes than required to reach the breakeven point.

Create energy and velocity. Putting the emphasis on closing sales sooner rather than later creates urgency on the part of salespeople. They’re then likely to do everything possible to encourage buyers to be ready to close on time. This way, requested delays for closing by a buyer suddenly become more personal to the salespeople and the manager. Contingency management takes on a whole new purpose.

A Key to Profit Forecasting for CFOs

Until you surpass your breakeven point, you’re simply covering fixed overhead. After that breakeven sale closes, each closing produces increased and incremental marginal profit contributions. Of course, reaching that goal in the second quarter, rather than the third, provides more time to produce profit for the year.

For builders with lot take-down schedules, it’s critical for sales management to understand the importance of these breakeven benchmarks. Take-down schedules from developers come in a variety of formats. For example, if you must take down X number in a quarter and don’t, there are consequences. You could lose your position to obtain additional lots. You may be forced to buy the lots even if you haven’t sold them. Interest and payment plans may be raised. None of these are good.

Builders who self-develop or buy lots using cash may not have a formal take-down schedule. That said, for every day, week, or month sooner that these lots close, the cash is in the builder’s bank account. Michael Lewis’ book Moneyball (made into a movie starring Brad Pitt) told the great story of Oakland A’s general manager Billy Beane, who had a passion for decision-making based on data rather than on gut instinct. With that strategy, he started winning more baseball games. In that same spirit, builders that develop a culture in which team members can influence the objective of moving up the breakeven goal line will net more profits—sooner, rather than later.

Advertisement

Related Stories

Sales + Marketing

Billboards Are Back! Tips for Billboard Marketing Success

A recent study shows the renewed power of outdoor advertising. But are home builders ready to go old-school with their sales and marketing efforts and embrace billboard marketing?

Builder of the Year

Schell Brothers' Unique Approach to Brand-Building

The home builder understands the difference between marketing and branding and leans heavily into the latter

Digital Marketing

How AI and VR Are Revolutionizing the Housing Market

From home pricing to virtual tours, artificial intelligence and virtual reality are changing the way today's homes are bought and sold