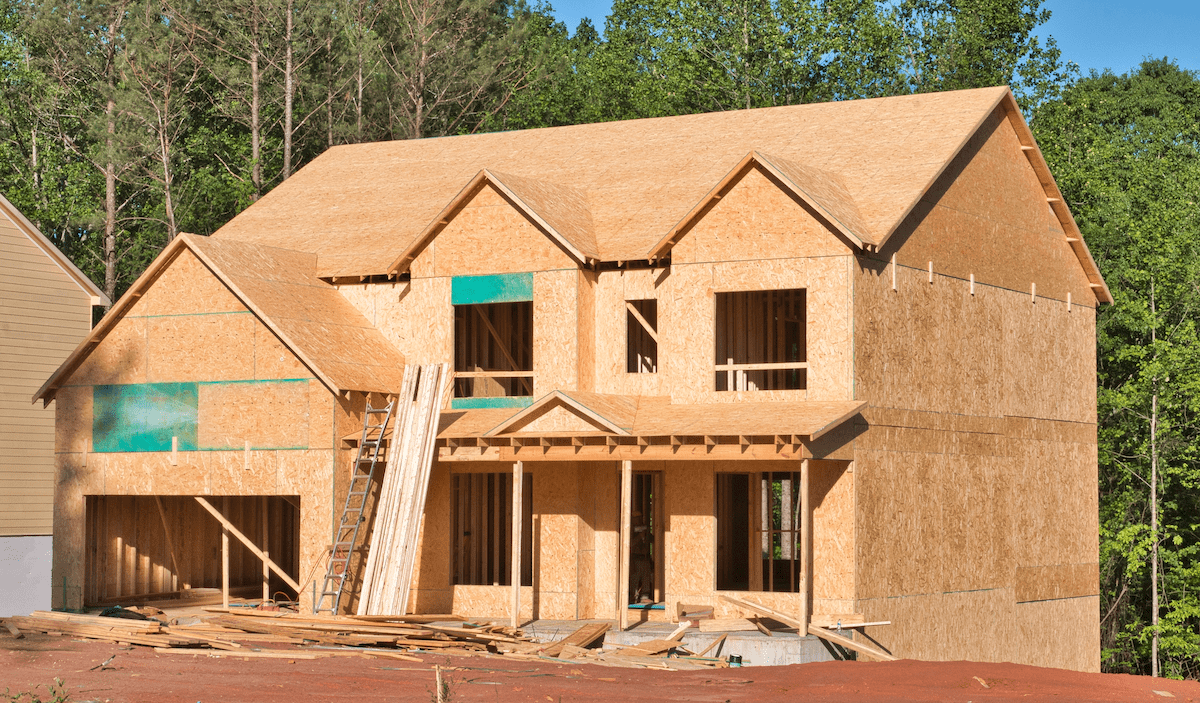

What Does It Cost to Build a Single-Family Home?

A closer look at the itemized costs in each stage of construction for a single-family home

A Look at the Boom in Home Builder Stocks During 2023

In 2023, stocks for the 10 biggest U.S. home builders outperformed the S&P 500. What does that say about the housing market?

Housing Demand Could Rebound in 2024 as Mortgage Rates Ease

The Mortgage Bankers Association predicts lower mortgage rates could bring homebuyers back into the market in 2024

The Federal Reserve Tightens Its Grip on the US Housing Market

Mortgage rates just surpassed a 23-year high, and experts say more rate hikes are on the horizon

Why Does the Housing Market Feel Like It's 1996?

The number of mortgage applications is currently at levels not seen since the mid-'90s

High Monthly Housing Expenses Are a Cause for Pause

With high median monthly mortgage payments, prospective buyers and sellers aren't too eager to jump into the for-sale market

Financials

Cash Isn't Just King, It's Your Lifeline

Four experts explain how paying attention to cash flow can help keep builders from robbing Peter to pay Paul

Off-Site Construction

Exclusive Research: The Off-Site Argument

Everyone says off-site construction is the answer to housing’s supply, labor, and affordability challenges—except single-family builders

Business Management

Profit Margin Study

A recent study tackling the cost of doing business in home building uses survey…

Construction

Labor Drives Regional Variation in Construction Costs

Recent analysis from BuildZoom found that between construction’s two major cost contributors, material and labor, material prices…

Credit Card Balances Growing in U.S.

More Americans are using their credit cards more frequently, as credit card balances grew 3.6 percent on average in 50 major U.S. cities, per a…

Business Management

You Guys Don't Count So Good: The 5 Most Common Home Builder Measurement Fails

Measurement failure—the source of many bad decisions in home building—ultimately means one thing: profit loss

Urban Placemaking

Small-scale manufacturers are helping move hard-to-sell retail space, and they’re bringing jobs back

Wanted: Workable Housing Solutions

In San Francisco and Atlanta, viable alternatives include a reimagining of the once-common boarding house

Business Management

2018 Housing Giants: Strategic Cost Cutting

Housing Giants seek economies of scale, operational efficiencies, and downsized designs in an effort to make homes more affordable