The majority of real estate developers look to increase their potential investment return by using other people's money. Assuming that the rate of return for the project is greater than the interest rate for the debt, the more debt placed on a property, the higher the potential return.

The use of borrowed capital to make an investment, called leveraging, does not always guarantee a return. Negative leverage is a situation in which the project experiences losses or is earning profits at a lower rate than the mortgage interest rate. Consequently, the developer receives less of a return than he would have had he been able to finance the project with no loan. This is because the developer must pay the lender a greater rate of return for the use of the borrowed money than that earned.

Also relevant to the debt and equity balance is the risk related to recourse lending. A recourse loan is a loan in which the borrower is personally liable for the debt in the event of a default. A non-recourse loan is one in which the borrower is not personally liable for the debt. A non-recourse loan is more risky for lenders because they must look only to their collateral, or any other signer on the loan, for repayment in the event of a default.

Generally a smaller developer will be required to personally guarantee the loan. As in all investments, builders must balance risk with return. Debt financing has the lowest cost, but the highest risk. With debt financing, if the payments are not made in accordance with the agreements, the lender may chose to foreclose on its collateral. The borrower can lose the property, all its equity and may be liable for any deficiency to the lender. Equity financing has a much higher cost, but a lower risk.

With equity money, equity investors assume more risk. They often lend without requiring collateral to secure the loan and offer more timeline flexibility for receiving a return. The more equity in a deal, the less risk of an unsuccessful project due to cash flow needs. There is less return because the equity investor requires a higher rate of return than a lender. The more debt financing (the greater the leverage), the higher the total return to the developer because the lender's interest cost is significantly below the rate of return that would be paid to an equity investor. There is higher risk because if the lender is not paid in time, the entire project can be lost. Thus, the combination of over leveraging and a cash shortage is a common cause of project failure. To maximize your return on a project, use a strategic mix of equity and lender capital.

Public Financing

The public sector offers a wide variety of land development financing alternatives to the real estate developer. These alternatives are covered below.

Tax Increment Financing

Tax increment financing (TIF) is most frequently used with larger mixed-use projects involving commercial property. TIF is based on the assumption that redevelopment increases property values. Following this assumption, the increase in property values leads to the "increment" component of tax increment financing. The increment in revenues is the difference between the municipality's income from property and sales taxes in the area prior to redevelopment as compared to after redevelopment.

Incremental funding is typically used in two ways: to pay directly for development improvements or pledged to the retirement of bonds issues by the municipality at the onset of the redevelopment program. For a developer who anticipates large expenditures for land acquisition and/or infrastructure, and who can present convincing evidence that the redevelopment will generate significant increases in land values (and the corresponding increase in tax revenues), TIF offers a potentially significant source of funds.

Tax Abatement Financing

Tax abatement programs encourage developers to undertake development projects because they offer relief from taxes. Through these programs, developers are relieved of all or part of the taxes on certain property during a specific time block. This serves as an incentive for development. Tax abatement financing frees developers from ordinary financing restrictions and thereby makes other improvements affordable or additional financing obtainable.

Special Districts

"Special district" is a general term that can include any of a number of geographically based jurisdictions created to carry out a specific function or functions.

Special districts are often used to finance land development where public purpose can be demonstrated. Public improvement districts are established within the boundaries of an existing municipality, or occasionally a county, while a metropolitan service district is established in an unincorporated area. Because of the special characteristics of service districts, developers use them more frequently to finance infrastructure than the other types of special districts.

Equity Financing

This type of financing can be used for land acquisition, land development and project construction. In relation to land acquisition financing, equity financing often makes up a large part of the total financing package. Equity is the funds contributed by the owners and/or investors, which together with debt provide the capital needed to acquire and/or develop the asset. Because equity is typically subordinated (junior) to debt, it is considered riskier. Typically, all operating costs and all debts for the project must be paid before the equity investor realizes any return. However, equity providers are often allowed to receive partial distributions even before debt has been fully repaid. Listed on the following pages are five methods of securing equity capital, in addition to that contributed by the developer/owner.

1. Joint Ventures

A joint venture involves you and one or more outside parties who join forces to provide capital and/or expertise for a project. You provide the expertise, and, in some cases, also make a capital contribution.

Landowners selling to developers also frequently become equity participants in joint venture activities. The landowner typically contributes land to the project in return for a proportionate ownership interest in the project. The land may also be entered into the deal at a negotiated price, which usually covers in full the equity needed to obtain development financing. The landowner may hold a mortgage that is subordinated to the development loan. Cash flows can be distributed on a priority basis.

An equity investor's confidence in you as the developer, the perceived risk of the project, the amount of equity required and your commitment all help to determine how much control they want over the project and the rate of return they will require for their investment.

2. Builder Cooperative Agreements

In a builder cooperative agreement, you and other builders share the risk and combine their equity and borrowing power to acquire and develop a larger project than they could take on individually. The co-op can be organized in various ways, such as:

- Each co-op party can assume different responsibilities within the project.

- Parties may prepare written agreements on architectural standards, types of building materials, number of speculative houses, quality of construction, and amount of advertising. Consensus around these considerations becomes important if co-op parties will build in the same subdivision.

- Parties can contribute service for a fee.

- After development, parties can share lots by lot draws or sales of the lots to themselves at determined prices.

3. Syndications

Syndication involves raising cash by selling ownership shares in a project through either a private or a public offering subject to the very strict regulations of the Securities and Exchange Commission. The cash is used to acquire land and develop the project. Because of their complexity and large amount of capital involved, developers often use a professional agency, called a syndicator, to arrange the syndication while assuming the role of information liaison between the lender and the investors.

Syndicators act as middlemen who market the ownership shares to prospective investors. Syndicators can also purchase the ownership shares from the developer and resell them. They receive a fee, usually up front, for their services but they can also receive a percentage of the profits based on performance as all or a part of their fee.

If the syndicator acts as a middleman, developers often remain as general partners in the project. If the syndicator actually purchases the ownership shares and resells them, the syndicator becomes the general partner and developers remain to provide expertise on a fee basis.

There are advantages and disadvantages to each arrangement. From a developer's perspective, the trade-off is between liability and control. The amount of liability you incur depends on whether you are a general partner or not. If the syndicator becomes the general partner, you lose control over the project. However, in exchange for loss of control, you receive a guaranteed fee and incur no liability.

4. Mezzanine Lender

A mezzanine lender provides a second loan, subordinate to a first lender, for the balance of the equity portion needed to complete the financing of a project that is not provided by the first lender. The mezzanine lender can be used to finance land acquisition, improvements and unit construction. These loans may be secured or unsecured, but are generally secured and can be made for up to 100 percent of cost not to exceed 75 percent of the loan-to-value. The term of this loan type is generally 12 to 36 months with personal guarantees. The loan can be structured with an interest reserve for the first lender and a project overhead draw. The interest is paid from the loan instead of the cash flow. The overhead draw finances your indirect expenses to run the project. Lenders generally charge 1 to 3 percent above the prime rate. You pay the lender monthly interest, unless funded in the loan, and upfront fees of usually 3 percent. When each unit is sold and title is transferred to the purchaser, you pay an additional release price fee of up to 10 percent of the loan amount being paid off or "released" at the time of closing, along with both principal and any outstanding interests.

5. Management Agreements

As an indirect method of equity financing, you can enter into a management agreement with an investor. These are also known fee-development agreements. A typical management agreement might provide for an investor to acquire an identified parcel of land and hold it in its own name. You would agree to perform the entitlements process, the development and the ultimate sale of the property. The investor pays for the out-of-pocket costs. When the property is sold, both you and the investor are reimbursed any out of pocket costs, the investor receives an agreed return on his investment, and you are then paid a fee based on a percentage of the profit of the project.

Management agreement arrangements present no or low-risk advantages. They provide equity financing without personal risk. Conversely, these agreements offer lower returns. The investor typically retains a substantial portion of the profits resulting in a higher total development cost than commonly realized through bank financing.

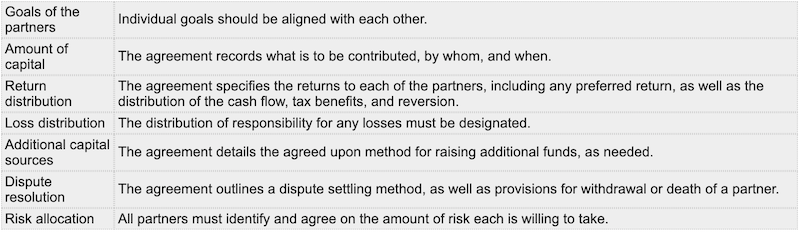

Common Components of Joint Venture Agreements

Consider These Tips to Appropriately Balance the Mix of Equity and Lender Capital

- Leverage Low Risk. If you feel comfortable with the risk, then leverage is the appropriate strategy to maximize returns.

- Use Equity for the Gap. Use equity financing to cover the difference between what you can borrow and the total amount you require to do the project. The equity investors' return often takes the form of a share of the profits paid after the lenders are repaid their loan and interest. Consequently, the equity financing involves more risk and equity investors require a higher rate of return than the interest rate that lenders chose. To the extent that lower rate lender debt can be substituted for higher cost equity money, the developer benefits from the increase in total profits resulting from the lower overall cost of the project financing.

- Replace Equity Financing. Replace equity financing with bank financing as quickly as possible. This will lower your initial cost of financing to increase your project return.

- Interest and Fees Over Profits. Pay a fixed rate of return to investors rather than a share of profits whenever possible. This limits the potential payout to investors and maximizes your return.

Advertisement

Related Stories

Off-Site Construction

New Study Examines Barriers and Solutions in Manufactured Housing

The study from Harvard's Joint Center looks at the challenges faced by developers using manufactured housing and how they're overcoming those barriers

Planning + Development

What's Standing in the Way of Building Housing Near Transit Stops

Two recent studies look at the factors hindering housing development near rapid transit

Financing

Credit for Builders Still Tight But Shows Some Easing

Credit for residential AD&C remained constrained during Q4 2023, but the good news is that tightening is less widespread than in recent quarters