Towns experiment with different approaches to stimulate new-home building during the recovery

A handful of Illinois towns are a laboratory of sorts for their differing approaches toward using incentives for attracting new home development.

Kendall County, Ill., once was the fastest growing county in the nation, according to the 2010 U.S. Census. The town of Yorkville alone issued 821 construction permits for single-family houses at the peak of the boom during 2006. By 2011, the town handed out just 43 construction permits.

Yorkville, however, almost doubled the number of permits granted last year thanks to the BUILD (Buyers of Undeveloped Infill Lot Discount) stimulus program. The city council recently extended for another year the program that pays potential residents to build new houses in the city. The incentive began in 2012 and was modeled after similar efforts offered by nearby Minooka and Manhattan. The city rebates a portion of the building permit fee up to $5,000, and the builder matches the rebate. The money is presented to the new homeowner—$10,000 is the maximum—when the certificate of occupancy is issued. Yorkville’s permit revenue from the 46 applications that qualified for the incentive added $540,000 in revenue to the town’s coffers during the past year.

Minooka started its stimulus initiative in 2008 by converting an unused $100,000 fund set aside for commercial facade renovations into a stimulus for owners who build new homes. Approximately 30 new homes have been built every year since then, and the Arbor Lakes subdivision, which saw a dozen lots sit empty for years, has eight projects underway.

“We’re happy about it,” said Steve Thornton, Minooka’s building and zoning director. “I see the permit activity report for the county and the surrounding communities that haven’t done anything have zero activity. We’re getting more calls from other builders.”

Manhattan in neighboring Will County takes credit for being the first Illinois community in 2008 that paid a stimulus directly to new home buyers. Eighty-nine families have since received rebates, but the program lost its luster and was discontinued in 2010.

“Over the last four years everything crashed and burned and no (builders) were calling; no one had access to capital,” said Bill Borgo, mayor of Manhattan.

Particularly problematic was that land values were not in synch with assessments used to determine impact fees. So Borgo approached all the school districts, parks, and other taxing authorities in the village and convinced them to drop their fees, starting in 2011. Manhattan also reduced its property tax rate by 30 percent and allowed builders to pay for permits at closing rather than upfront. The policy enables builders to break ground sooner with less red tape and delays. Yorkville and Minooka later emulated that practice by allowing builders to pay fees upon granting the occupancy permit.

In all, the cost of a permit for a four-bedroom single-family home in Manhattan was cut by as much as $10,000. The village is on pace to issue 50 permits this year compared with 27 in 2012 and is drawing interest from commercial developers.

“The biggest thing for builders is cash flow and a number of builders commented to me that paying at closing is so very vital to them,” said Bargo. “We’re seeing more rooftops with good disposable income inside them. That’s what commercial developers want.”

Home builder bonds still draw speculative grades

Although bond prices issued by home builders are trading at pre-recession levels, credit rating agencies Fitch and Standard & Poor’s have assigned speculative grade ratings for most of the sector.

The credit metrics for many builders issuing public debt is still weak relative to their rating categories, said Fitch Ratings. Before ratings can improve, builders need to show meaningful improvement and generate considerably greater profitability and funds from operations.

“Given pressures seen during the previous downturn and the significant deterioration in credit metrics, issuers will have to demonstrate that they can sustain the improvement in credit metrics and, at the same time, remain disciplined in their land strategies in order for rating upgrades to occur,” Fitch said in written statement released last month.

However, Fitch posted a stable rating outlook for the overall industry thanks to strong liquidity positions for issuers, manageable debt securities, and the growth in housing activity expected this year.

Standard & Poor’s likewise has a stable outlook for the category. Seventy-eight percent of its home builder bond ratings for 2013 are graded “stable” compared with 60 percent last year and 5 percent in 2008. The improving market helped push down yields on five-year maturities issued by builders that actively trade debt to a first quarter range of 3.6 percent to 5. 8 percent, compared with a year ago when yields ranged from 5 percent to 9 percent, according to Standard & Poor’s.

While a small number of home builder bonds were deemed investment grade—Toll Brothers and MDC Holdings, for example—credit quality among issuers has improved. Standard & Poor’s graded 43 percent of builder debt as BB compared with 33 percent last year, while companies receiving the highly speculative B rating declined to 43 percent this year compared with 53 percent in 2012.

Ontario’s building code embraces DWHR technology

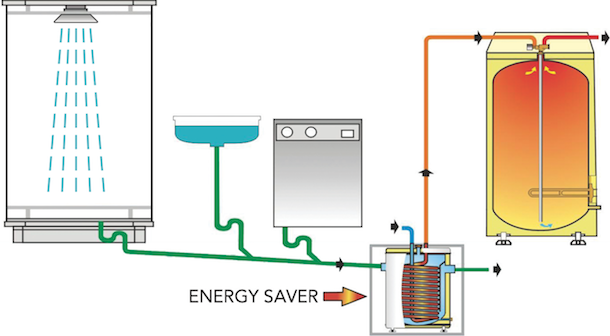

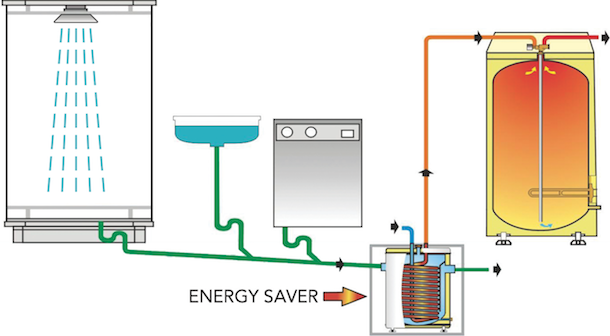

Ontario, Canada, became the first province or state in North America to adopt drain water heat recovery (DWHR) as part of the province’s building energy code.

The technology captures heat from gray water that flows from shower and dish washer drains and transfers that energy into a potable water heating system. Proponents contend recovering this heat energy can reduce annual water heating costs by 20 to 35 percent for residential and multi-residential units and cut total home energy usage by as much as 10 percent.

Ontario’s Ministry of Municipal Affairs and Housing amended the 2006 building code effective March 15. The amendment requires DWHR to be installed in low-rise residential constructions to receive drain water from all showers or from at least two showers in dwellings with two or more showers.

Canada is home to at least three DWHR manufacturers including Kitchener, Ontario-based Renewability Energy, whose president and CEO Gerald Van Decken lobbied for the building code change since introducing Power-Pipe, his company’s DWHR product, to the market in 2004. Since then, 25,000 units have been installed in North America and Europe. Enbridge Gas Distribution, Canada’s largest natural gas distributor, partnered with Renewability and offered builders and homeowners one free DWHR unit per new home. More than 150 builders and 5,000 new houses in Ontario participated. Builders such as Empire Communities, Vaughan, Ontario, have made Power-Pipe a standard feature in all its new homes.

DWHR already is part of building codes in France. Minnesota Power, an electric utility serving Northeast Minnesota and Northern Wisconsin, offers rebates to homeowners for installing this technology. Some states such as Oregon offer home owners state income tax credits for installing DWHR.

More home builders head for Wall Street

The appetites of investors looking for opportunities to ride the housing recovery and the desire of privately held builders to raise capital is generating a round of public filings the industry hasn’t seen since 2004.

William Lyon Homes, Newport Beach, Calif., announced in mid-April that it intends to raise as much as $200 million through an initial public offering. Also, UCP, San Jose, Calif., seeks to raise $125 million by listing on the New York Stock Exchange.

The same week as the William Lyon announcement, Taylor Morrison Home began trading on the NYSE. The Scottsdale, Ariz.-based company raised $526 million through its IPO of 28.6 million shares, up from the originally planned issue of 23.8 million. Company executives also announced plans for a $500 million debt offering.

As of press time, four builders have taken the IPO route so far this year.TRI Pointe Homes in January was the first home builder to go public since 2004. The Irvine, Calif.-based company raised $155.6 million.

Although bond prices issued by home builders are trading at pre-recession levels, credit rating agencies Fitch and Standard & Poor’s have assigned speculative grade ratings for most of the sector.

Although bond prices issued by home builders are trading at pre-recession levels, credit rating agencies Fitch and Standard & Poor’s have assigned speculative grade ratings for most of the sector.

The appetites of investors looking for opportunities to ride the housing recovery and the desire of privately held builders to raise capital is generating a round of public filings the industry hasn’t seen since 2004.

The appetites of investors looking for opportunities to ride the housing recovery and the desire of privately held builders to raise capital is generating a round of public filings the industry hasn’t seen since 2004.