A private-equity fund that generated big profits by buying up empty data centers after the technology-stock bust in 2000 is now gambling on foreclosed homes, according to the Wall Street Journal.

The fund, GI Partners in Menlo Park, Calif., announced a $250 million investment in Waypoint Real Estate Group, an Oakland-based company that buys foreclosed homes at discounts and rents them out to tenants. The investment is among the largest to date by an institutional investor in the single-family rental space.

Richard Magnuson, managing director of GI Partners, said the private-equity fund could eventually expand its investment to $1 billion over the next two years if the initial round is successful.

To read more, click here.

Advertisement

Related Stories

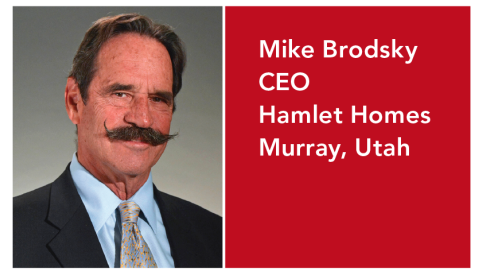

Hamlet Homes' Mike Brodsky on Finding Successors and Letting Go

A transition that involved a national executive search, an employee buyout, and Builder 20 group mentorship to save the deal

Time-Machine Lessons

We ask custom builders: If you could redo your first house or revisit the first years of running your business, what would you do differently?

Back Story: Green Gables Opens Up Every Aspect of its Design/Build Process to Clients

"You never want to get to the next phase and realize somebody's not happy."