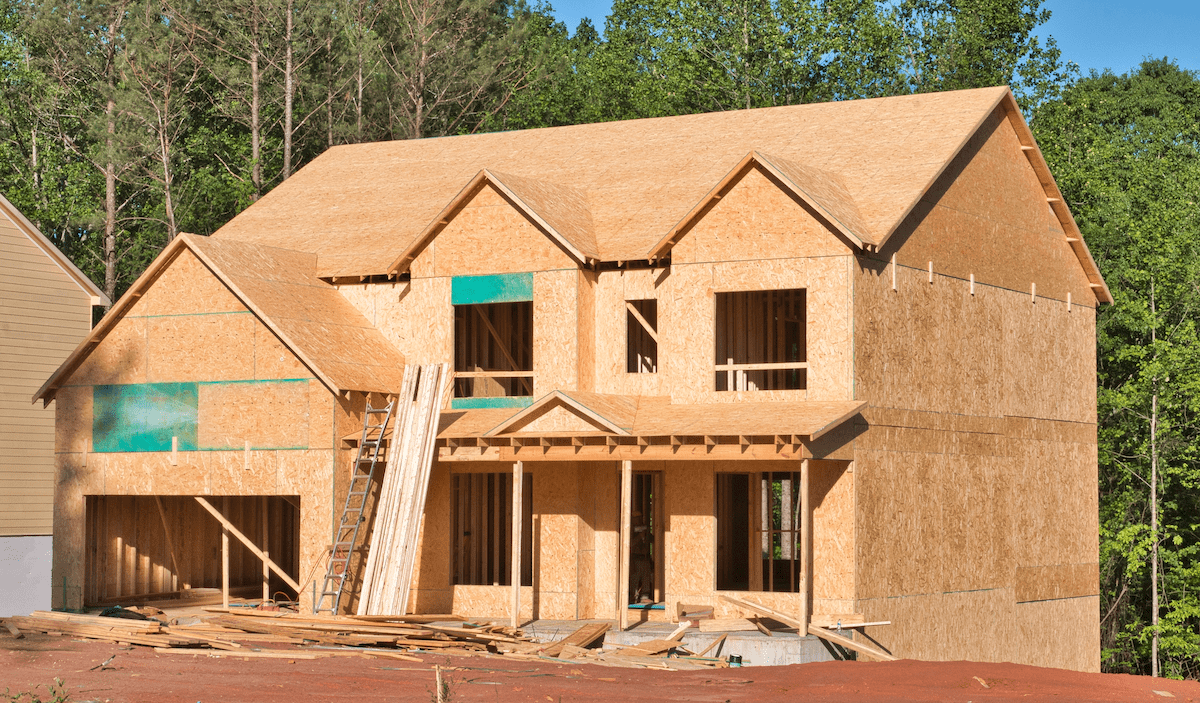

What Does It Cost to Build a Single-Family Home?

A closer look at the itemized costs in each stage of construction for a single-family home

A Look at the Boom in Home Builder Stocks During 2023

In 2023, stocks for the 10 biggest U.S. home builders outperformed the S&P 500. What does that say about the housing market?

Housing Demand Could Rebound in 2024 as Mortgage Rates Ease

The Mortgage Bankers Association predicts lower mortgage rates could bring homebuyers back into the market in 2024

The Federal Reserve Tightens Its Grip on the US Housing Market

Mortgage rates just surpassed a 23-year high, and experts say more rate hikes are on the horizon

Why Does the Housing Market Feel Like It's 1996?

The number of mortgage applications is currently at levels not seen since the mid-'90s

High Monthly Housing Expenses Are a Cause for Pause

With high median monthly mortgage payments, prospective buyers and sellers aren't too eager to jump into the for-sale market

Only one in four got assistance from Obama's mortgage assistance program

Of the 2.7 million homeowners who tried to get mortgage help from the Obama administration’s assistance program, only a quarter actually got their monthly payments lowered, The Wall Street Journal reported. Roughly 680,000 homeowners got payment modifications under the Home Affordable Modification Program.

Mortgage rates drop slightly

After a slow but steady climb, mortgage rates eased up last week, according to The Wall Street Journal.

Toll Brothers reports unexpected profit in first quarter

Toll Brothers, the largest U.S. luxury home builder, posted a surprising first-quarter profit, beating market estimates, Bloomberg reported. The company managed to increase revenue, cut costs, and reduce property impairments. Net profit was $3.4 million, or 2 cents per share, compared with a loss of $40.8 million last year.

Housing inventory declines in January

In a strange twist, the number of homes listed for sale actually fell in January, according to The Wall Street Journal.

Mortgage rates skyrocket

Mortgage rates jumped to their highest level in ten months after crossing the 5% barrier for the first time in half a year.

Obama’s mortgage-market reform plan calls for winding down Fannie Mae, Freddie Mac

The Obama administration’s long-awaited proposal for reforming the U.S. mortgage market calls for shuttering both Fannie Mae and Freddie Mac over a period of five years or more. The two agencies, along with the Federal Housing Administration, currently provide more than 90 percent of housing finance.

Federal mandate halts home resale fees

Under a new mandate from the Federal Housing Finance Agency, Freddie Mac and Fannie Mae will stop providing mortgages on homes that have home resale fees. The fees, also known as private transfer fees, are when the owner pays a percentage of the sales price to an entity at the time of sale. They have already been outlawed in 19 states.

Shadow inventory shrinks as banks employ loan modification efforts

America’s shadow inventory — mortgages that are either delinquent or in foreclosure but haven’t hit the market yet — continues to shrink, according to an S&P report. One potential reason for the decline is that fewer loans are resulting in foreclosures since banks are trying to modify them so that homeowners can stay.

PB February 2011

5 Trends in Infill Housing | Driving Consumer Traffic | First-Time Home Buyer Preferences

Report: Bring private money back to mortgage industry

A report from the liberal Center for American Progress calls for attracting as much private money as possible into the mortgage market, The Wall Street Journal reported. Currently, nine of out 10 new loans have some kind of government backing. The proposal recommends private firms, chartered by a federal regulator, issue mortgage-backed securities.