This past fall I had the opportunity, if not exactly the pleasure, of hanging out at a finance and development conference in Las Vegas as a member of a panel discussion about how to value land, projects, and builders.

There were about 250 expensive suits, more neckties than I have seen in 20 years, and much talk about “basis points.” These were heavy hitters, well-pedigreed and controlling a large portion of the land and project development in the United States. I joke that I got an MBA to know what the enemy is thinking. There is at least a grain of truth in that. These folks are not the enemy, but they do talk and think differently from builders.

The good news is they hold the keys to a huge vault of money and those funds are looking for a home—or at least some land for building houses. The bad news is this money is impatient, temporary, and risk-averse. It wants to move in, collect big returns, and then move on quickly to the next big deal. Several panel members were seeking 18 to 20 percent annual returns before they’d grace your project with their cash. They’ll support you—but at a premium price.

The banks were not well represented. This was mostly private equity with a certain Wild West feel to the proceedings. In my usual role, I offered a contrarian view on something they have long held dear: how to

value a piece of land, a project, or a builder. I began by telling them in a firm voice, “You guys don’t count so good!” As the son of an English teacher, I know that’s not proper grammar, but it got their attention. Then I told them a less-than-due-diligence story.

Straightforward, or No?

Twenty years ago, I tried to worm my way into the asset management committee of my national builder employer. As vice president of

quality, however, what could I contribute? Due diligence was pretty straightforward stuff. A division submitted a pro forma with a price on the land determined by comparisons to other projects in the area. They searched for legal obstacles, took a cursory look at the market and

demographics, and then estimated development costs based on history. If the deal met our internal rate of return, and price and terms were good, we did the deal. We did hire an exceptional guy who brought an entirely new approach to market analysis, which made a huge difference over time.

We began to look for land that matched what we were good at, instead of getting the deal and then figuring out what to build, whether we knew how or not. That approach tempered the deal-chasing mentality and reduced risk, but it was still not a complete picture. Despite my efforts, I was never asked onto the committee. My notions about things we should evaluate under the banner of due diligence were thought to add

needless complication to a simple process.

Then one late-fall Saturday morning, my home phone rang, displaying an unknown area code. I picked up and heard in a soft whisper, “Thank you, Jesus.” This is a first, I thought. Perplexed, I listened in silence until a female voice asked, “Mr. Sedam?” pronouncing my name incorrectly. Most people would have just hung up, yet something in her voice gave me pause, so I offered a tentative, “May I help you?” For the next 15 minutes, I listened while the 30-something woman I’ll call Lydia told me through intermittent sobs in a soft Carolina accent a horrific story that left me sitting on the kitchen floor, trying to comprehend.

A Woeful Tale

Lydia and her husband had purchased their new home the previous spring from a builder my company had just

taken over that summer. This builder had a less-than-stellar reputation, and I tried to raise a red flag saying we should evaluate them more deeply than through the usual procedure of land, legal, and terms; but on paper, the deal was a winner. We were eager to get our hands on these lots in an emerging market that was easily reached from one of our older, established locations.

Lydia’s family became very close with their neighbors who had a teenage son. Lydia hired him that summer to babysit her young special-needs child. At first they seemed great together, but in time Lydia’s son began acting out with a litany of bizarre behaviors. After much counseling, it finally emerged that Lydia’s son was being molested by the boy next door, who confessed when confronted. The desperate cries of the offending boy’s mother, the begging by the father, and the pleading assurances that the teen would get counseling left Lydia and her husband reluctant to press charges. They immediately moved in with her parents and put the house up for sale. The very day they left, their son’s behavior began to improve. There was no going back. I could hardly fathom the gut-wrenching anguish this woman felt, but what did this have to do with me or my company?

As it turns out, a lot. When the first offer arrived on Lydia’s house, the inspector found something disturbing. There was no

insulation in the walls. How could that be? Lydia called the division. She got the brush-off and a, “We’ll get back to you.” The company was not sure if they were responsible for the warranty on homes they did not build. The real estate agent told Lydia that without insulation, there could be no sale, and the estimate for a retrofit required cash they did not have.

Lydia’s next call to the home office was equally frustrating. The corporate policy simply sent homeowners with complaints back to the original division to solve on the local level. With her sense of desperation growing, Lydia then dug up my name, saw my VP Quality title and, after a bit more searching, found my home phone number. She told me I was her “last hope.” For the well-being of her son, Lydia and her husband had to sell their house. It was defective and she needed our help. The only response I could think of was, “Of course, I’ll get on this first thing Monday morning.”

On Monday I quickly determined that we were indeed officially responsible for the

warranty on more than 100 homes in the new location, including Lydia’s, so that was one battle avoided. I got the boss’s support to both quickly initiate repairs on Lydia’s home and also quietly evaluate all other homes in case this was not an isolated incident. Only a few of us ever knew the horrific circumstances that drove the inspections, but we uncovered a long list of discrepancies, and Lydia’s home was not the only house missing insulation. We spent a lot of time speculating just how this got by the drywaller, the sider, and the superintendent, not to mention the inspector; but the damage was done.

Had we conducted this evaluation up-front, the dollar amount for the repairs would have at minimum changed the valuation and may have killed the deal outright. Lydia’s house and all others were fixed quickly but the word about the quality issues got out to the community, including the city council and inspectors. Whether we built them or not, our name was now on the door. I always felt that with good PR, we could have turned this debacle to our advantage, but the incident soured everyone to the new location. Within a couple of years, we were out of there with a net loss. The party line was, “It’s a bad market.”

No Shortcuts

Even after this awful episode proved that a deeper dive into due diligence could have saved seven-figure money, I never found my place on the asset management committee, but I never forgot the lesson. Short-cutting the valuation process has consequences. As I listened to panel after panel of financial aces at the Las Vegas conference, I realized most developers and those who fund them still evaluate land, projects, and builders using a very narrow list of criteria and thus their risk is high. Maybe that’s why they need a 20-percent return?

There is a definite parallel here to the work I have been doing for years to educate construction and

purchasing on the critical difference between initial price and

total cost for both materials and labor. Lest anyone think I claim this as an original concept, the venerable quality guru

Dr. W. Edwards Deming preached incessantly on this principle for decades prior to his death in 1993. Most of you know the end of that story: Japan listened, we did not, and it took the United States more than 50 years to catch up. There is a likewise critical difference between due diligence by a limited criteria set versus deep, full-value analysis with all essential factors considered. Skip any of it at your peril.

Consider Cycle Time

For most investor/developers, the first criterion in due diligence is price and terms. But to stand this subject on its head, let’s consider it in a completely different way. Price and terms are not criteria, they are the outcome of thorough due diligence. How can you effectively price something, then negotiate favorable terms without fully knowing the asset?

One prime example so often overlooked is the

cycle time of the builder. A builder with a cycle time of 90 days (four turns) will not only show much higher gross margins than a builder with a cycle time of 120 days (three turns) but will turn that land and thus your investment 25-percent faster. His ability to pay you increases substantially while you are in and out much quicker. Return up. Risk down. The impact can hardly be overstated, yet cycle time rarely comes up as a primary consideration in due diligence.

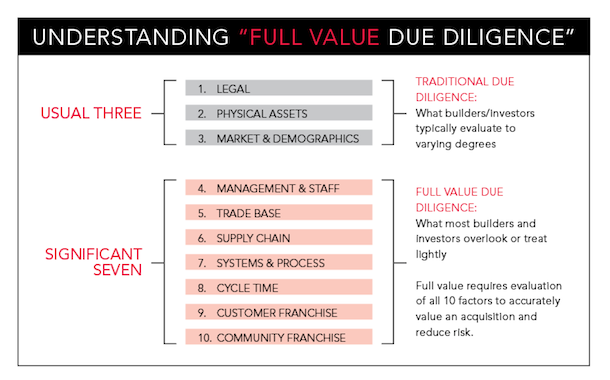

The following is a brief overview of a “Full Value Due Diligence” model for evaluating an investment in land, a project, and/or a builder.

1. Legal Clear title is a basic requirement, well understood, with armies of attorneys to aid and bill us in this arena.

2. Physical assets 25 years ago we concerned ourselves with topography, soil quality, visual appeal, and lot fit. A plethora of constituencies today demand deeper investigation into drainage, site contamination, environmental impacts on land, animals, and noise, and even historical/archaeological concerns.

3. Market and demographics The best companies do a solid job here and many consultants are available to help. Yet those who do this work say most builders and developers scratch the surface at best and, at worst, still rely on gut instinct to purchase land.

4. Management and staff Every developer alive has seen a good investment go bad due to a management team not up to the challenge of the build-out. Yet how often do we undertake a professional evaluation of such a team’s capabilities?

5. Trade base There is no single factor driving profitability more today than securing competent trades at a competitive price. The builder who maintains these relationships enables profit and reduces risk. It requires a resolute, intentional strategy, never achieved informally.

6. Supply chain Manufacturers have been slow to bring plants back on-line due to the uncertainty that another

government shutdown, the Greek economy, the Mayan calendar, or perhaps solar flares will smack down the current housing recovery. Spot shortages are occurring and will get worse before they get better, impacting returns.

7. Systems and process I have worked with 200 builders and the capacity of their systems and process are so different as to defy description. The outcome is huge variation in how much product they can manage and how well, which dramatically impacts quality and

profit.

8. Cycle time There are few cardinal rules in building but here’s one: The

best builders are the best schedulers, and the best schedulers are the best builders. Period. (See above for more discussion.) Responsible due diligence is impossible without knowledge of a builder’s cycle time.

10. Community franchise Whereas customer franchise focuses on the micro relationships with homeowners, community franchise acknowledges the macro relationships with zoning boards, planning commissions, inspection departments, and even other builders. A builder’s ability to work and play well with others has a major impact on risk and profit.

It's impossible to buy a liability-free asset. Our task is to optimize asset return, taking all strengths, risks, and liabilities into account. Without fully understanding all risks and strengths, how can we possibly say we’ve done due diligence? With a well-structured process, performing due diligence does not need to take longer. For every investment in land, a project, or a builder, challenge your team to play devil’s advocate and create a list of “10 reasons why we should not do this deal.” Use the 10 “Full Value Due Diligence” criteria as checkpoints. Now you can determine the right price and terms, so get out your checkbook and let the negotiations begin.

Next, we will go into more detail on the full value model with specific examples. I welcome your input and suggestions for clarification, inclusion, or deletion regarding any of the criteria.