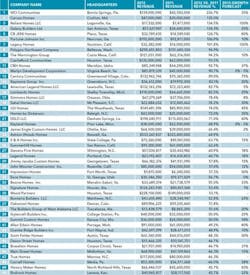

Big Gainers

Sure, low interest rates were the main engine that pulled the home building industry up 10.9 percent to 649,000 completed houses in 2012 compared with the previous year. Market momentum might have been enough for some builders to generate some kind of revenue gain after enduring a long economic season of cutbacks and inactivity. But the companies who reported revenue growth of 40 percent or more have a common strand in their stories. They started setting the table for their rebound as far back, in some cases, as the 2006 housing crash.

After selling off speculative land holdings in 2006 and 2007, Fred Delibero, president and CEO of Summit Custom Homes in Lee’s Summit, Mo., knew he couldn’t continue to run his company as he did before the recession. So Summit Custom scrapped its product offerings and focused on building only two-story houses, which appealed to a buying group that was ready to deal just as housing started to bounce back.

“I recognized early on that we needed to differentiate ourselves in the market,” Delibero said. “We were building a broad spectrum of plan types at different price points.”

Many builders might have deemed the supply and demand situation for prime lots to be a big picture variable that was beyond their control. But rather than wait out the downturn, managers for Granite Ridge Builders decided to become their own land developer.

“Many people asked me: If a lot was bad five years ago, is it still bad? Yes,” said Tony Reincke, president of the Fort Wayne, Ind.-based company. “[Many] people picked the good ones, so we had to reproduce our own good lot inventory.”

Filing for bankruptcy can not only be disappointing, it can also create acrimony and sever relationships. Yet Jeff Caruso navigated his way through the rough seas of Chapter 11 reorganization with tons of communication. So much so that Caruso Homes, Crofton, Md., held on to its ties with investors, suppliers, and the trades. The company is leaner and running more efficiently with back-office systems that handle contract management, punch lists, and social media tracking. Today the builder also is one of the top revenue gainers on our chart based on percent change between 2012 and 2011 financial data.

(CLICK HERE FOR AN ENLARGED VERSION OF THE CHART ABOVE)

Almost 26 percent of the 242 builders who submitted financial data for Professional Builder’s annual Housing Giants report (see May 2013 issue and HousingZone.com) recorded revenue exceeding 40 percent. They turned the downturn into an opportunity to retrench and improve. Some even hired more talent and raised marketing budgets.

We reached out to 11 builders on our list of Big Gainers so they could share their strategies for success.

Granite Ridge Builders - Fort Wayne, Ind.

Caruso Homes - Crofton, Md.

Warmington Group - Costa Mesa, Calif.

Marlyn Development - Virginia Beach, Va.

Jimmy Jacobs Custom Homes - Georgetown, Texas

American Legend Homes - Lewisville, Texas

Fortune-Johnson Inc. - Norcross, Ga.

Summit Custom Homes - Kansas City, Mo.

DSLD Homes - Denham Springs, La.

Century Communities - Greenwood Village, Colo.

CBH Homes - Meridian, Idaho

Granite Ridge Builders - Fort Wayne, Ind.

Caruso Homes - Crofton, Md.

Warmington Group - Costa Mesa, Calif.

Marlyn Development - Virginia Beach, Va.

Jimmy Jacobs Custom Homes - Georgetown, Texas

American Legend Homes - Lewisville, Texas

Fortune-Johnson Inc. - Norcross, Ga.

Summit Custom Homes - Kansas City, Mo.

DSLD Homes - Denham Springs, La.

Century Communities - Greenwood Village, Colo.

CBH Homes - Meridian, Idaho

[PAGEBREAK]

Granite Ridge Builders

All of the good lots had been picked over. So rather than buying the bad leftovers, Granite Ridge Builders created its own lot inventory.

“We became our own developers,” said Tony Reincke, president of the Fort Wayne, Ind.-based builder. “We’re trying to pinpoint the really good locations, do the development ourselves, and that has worked out famously.”

Granite Ridge stopped buying lots five years ago. The company prepared for pent-up demand by hiring subcontractors to set up lots in markets where houses haven’t been built or where construction wasn’t very active during the past five-to-10 years. The 8-year-old company niche-marketed its way to $43 million in revenue last year, a 48.9 percent jump from 2011, on 276 closings. Reincke expects the company’s volume to hit $50 million this year; the builder is on pace to sell 350 homes.

Another niche market that is paying off for Granite Ridge is the villa concept—enclaves or subdivisions where the builder or property manager, not the homeowner, maintains the exteriors and landscaping.

“People are really enjoying the no-maintenance (aspect),” Reincke said. “One thing that was unexpected in that niche market was that young professionals, not just the retired people, love that market.”

Another opportunity is the U.S. Department of Agriculture’s Home Loan, a program that offers consumers a zero-percent loan and low interest rates with no private mortgage insurance for purchasing homes in USDA-designated rural areas. Granite Ridge used the program to help buyers build in small towns and in small veteran communities that are near bigger markets where people commute to work.

Reincke also staffs full-time draftsman and decorators at a very large studio where buyers can go to customize their new home plans.

“People really do enjoy customizing to the way they want and, as long as we can educate them about the products they can pick from, they make those decisions pretty easily,” Reincke said.

[PAGEBREAK]

Caruso Homes

Reputation matters. But flashing your company’s credentials after emerging from Chapter 11 reorganization can be as tough as mixing a yard of concrete with a hand trowel. Crofton, Md.-based Caruso Homes filed for bankruptcy protection in 2008, liquidated much of its land holdings, and emerged from reorganization in 2009 as a leaner company with 30 full-time employees, down from 160 before bankruptcy.

To combat the doubters and the naysayers, CEO Jeff Caruso implemented a policy of no surprises and “100-percent communication” with buyers, subcontractors, trade contractors, and suppliers.

“If our investors ever had any questions, we welcomed them right into the office and said, ‘Let’s take a look at what we’re doing,’” Caruso said. “We keep them up to date with reports. Every investor we ever did a deal with has come back to do a second deal with us. It’s because we always had an open-book policy with them.”

Though the builder is smaller than before its Chapter 11 filing, Caruso Homes saw 2012 revenues grow 135 percent to $47 million and expects to double its closings this year. The company operates with more automated systems for contract management, punch lists and tracking emails and social media activity. Rather than building houses in Virginia and Maryland that averaged more than 3,400 square feet priced between $600,000 and $900,000, Caruso went smaller with houses averaging 3,000 square feet priced in the $400,000s. But that product is changing because the company stayed on top of changing trends by conducting focus groups with buyers.

“We redesign our product constantly to meet the needs of the buyers,” Caruso said. “The buyers are going right back to where they used to be. The two-story family room was for a short period of time seen as a little excessive, but they’re back in demand."

He added that buyers did pull back to smaller houses for a while, but the market-rate buyer today is looking for the same type of bigger house designs they were looking for five years ago.

“Even though we went through reorganization, our buyers are pleased that we never missed a beat,” Caruso said. “The message was [that] Caruso Homes is in it for the long run; we had an open-book policy with everyone, and our customer is No. 1, no matter what. All our subs and employees had to remember to take care of the buyer because your reputation is what matters. Our buyers never had to give up anything (because) of the downturn.”

[PAGEBREAK]

Warmington Group

Warmington Residential set up its stellar growth in 2012 by believing in the impending recovery as early as 2010. The Warmington Group division backed that bet by becoming aggressive. The Costa Mesa, Calif.-based builder hired additional staff for its land acquisition team and made improvements in operations, design, and sales. The company closed out unprofitable legacy deals made before and during the recession. While the downturn zapped access to capital for many businesses, Warmington strengthened its long-term relationships with equity investors and lenders, enabling the company to finance many deals that other private companies could not.

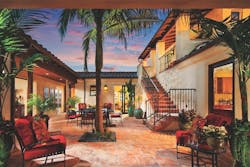

Next was remaking product. Warmington focused on creating communities that were special and different from anything found in the market. Among those offerings were single-story homes and predominantly single-story living—a product that is scarce in the market today. Warmington also married its floor plans with true indoor-outdoor living, customizable options for some locations, and features reflecting tomorrow’s market trends. One such product, the Plan 1 luxury home for the Legacy Collection in Covenant Hills in Ladera Ranch, Calif., was a Golden Nugget Award of Merit winner for the Single Family Detached Home Over 4,000 Square Feet category. At least 18 of the million dollar-plus homes in the Legacy Collection have sold since debuting in November 2012.

Warmington also integrated upgrades and designer selections throughout its Chateau Interiors & Design division. The company considered extensive research and planning to enhance designs for communities that were better suited for their targeted buyer groups.

Revenue last year for Warmington Group—which also includes Warmington Properties Inc., a full-service real estate company, and its interior design firm—soared 94.2 percent to $121 million with Warmington Residential posting 296 closings. The builder expects a 25-percent increase in 2013.

“We have largely done the work necessary to reach these goals in 2013,” said Jim Warmington Jr., president and CEO. “We own and are building the communities, or have entitled the properties we may sell, plus we have hired the necessary staff. To reach our goals for 2014, we are continuing with more of the same. Specifically, adding staff where necessary, aggressively focusing on land acquisition, and creating special and different communities and home designs.”

Warmington builds single-family homes and multifamily houses and apartments and is most active in California and Nevada.

[PAGEBREAK]

Marlyn Development

Marlyn Development started as a custom home builder when it was founded in 1983, but has since planted its flag in the multifamily market, building almost 7,000 new units and renovating more than 1,600 in Virginia, North Carolina, and Maryland.

Last year’s revenue for the Virginia Beach, Va.-based contractor jumped 90.7 percent to $85.8 million on the closing of 903 low-rise units. Marlyn expects 2013 revenue to match or slightly exceed 2012. Ninety-five percent of the business is focused on for-rent multifamily construction.

“It has been Marlyn Development’s philosophy of providing a quality product at a fair value that has carried our company through good times and bad,” the company said in a statement. “We work hand in hand with our clients from project inception until completion to deliver on this philosophy.”

Marlyn credits its growth to being well-versed in all types of construction from affordable to high end, and being able to navigate any type of construction financing. Project managers, superintendents, and subcontractors all work toward the common goal of making the owner and developer successful. Accomplishing that end multiple times helped establish long-term bonds to the point where Marlyn has been the sole builder for some owners and developers for more than 25 years.

“We will continue to follow our philosophy of providing a quality product at a fair value as we adapt to the changing market,” the company said regarding 2013. “Marlyn has developed a unique pricing structure that has provided nice benefits to our clients.”

[PAGEBREAK]

Jimmy Jacobs Custom Homes

Growing revenues in 2012 by 57.8 percent from the previous year is a figure any builder would be delighted to tout. But the folks at Jimmy Jacobs Custom Homes also have a lot of pride in another number—70 percent. That’s the baseline percentage of American-made materials that the Georgetown, Texas-based company sources to build custom and semi-custom homes under its Made in America program.

One such home was a mortgage-free house presented last year to an Army staff sergeant who lost both his legs after stepping on an improvised explosive device while serving his fourth tour in Afghanistan. The handicapped-accessible home was featured last year on an episode of ABC TV’s “Extreme Makeover: Home Edition,” one of several houses the builder has donated since 2006 to veterans and needy families through the TV show. American Made launched last September as a way not only to give back but also to create and sustain American jobs by using competitively priced products made in the U.S.

Jimmy Jacobs reported $66.2 million in revenue in 2012 with 144 homes sold in its core markets—Austin, Georgetown, San Antonio, and New Braunfels, Texas. The company projects 2013 revenue will grow 12 percent and closings will increase 23 percent. To get there, Jimmy Jacobs will continue sales education for its staff, maximize efficiency through process improvement, and execute more targeted marketing strategies.

“We have worked to better streamline the sales and building processes internally,” said Rebecca Whitehurst, marketing director. “We have emphasized through coaching and counseling of our sales team that it is important to truly understand our buyers’ needs. We need to be diligent in making sure that we ask the right questions in order to assist our guests in building their dream home. For the building process, we constantly search for ways of improvement through new process creation and tool implementation. By looking closely at our internal processes, we successfully address efficiency opportunities and continue to improve on our build timeline.”

Jimmy Jacobs offers floor plans custom-designed by an in-house drafting team, as well as detailed ceiling treatments, commercial-grade cooking appliances, and quality materials including spray foam insulation.

[PAGEBREAK]

American Legend Homes

What do developers like to see in a builder?

“We are very efficient in analyzing deals and making decisions,” said Kevin Egan, president of American Legend Homes.

The Lewisville, Texas-based company has a couple more qualities that developers admire: a clean balance sheet and very few legacy issues with underperforming communities. Consequently, the semi-custom builder was able to be very aggressive with contracting new lot opportunities since the market started improving in early 2010. In all, American Legend has contracted more than 24 new deals and future phases.

“In early 2011, we hired a new land acquisition manager, who has been extremely good at developing relationships with developers, builders, and brokers. He has done a tremendous job selling what we do and following up to ensure we are top on the list for any new deals,” Egan said.

The company hired approximately 15 people in 2013 and intends to add four or five more by year’s end. Other changes that have helped the builder grow include adding more than 30 new house plans, including a new zero-lot-line product that will be offered starting this fall. American also fed the momentum with a branding campaign that launched in 2012. The “Legends Begin at Home” initiative includes billboards and prints ads in regional and local publications featuring American Legend buyer families in their new homes.

The builder posted $132 million in 2012 revenue, an 82.7-percent increase from the previous year, on 385 closings. Egan expects the company to close 460 homes this year and bank $164 million in revenue.

American Legend and sister company Belclaire Homes build in the Dallas-Fort Worth area, including McKinney, Frisco, Lewisville, Allen, The Tribute, Flower Mound, Celina, and Keller. The 100-percent Energy Star builder allows customers to modify existing plans to meet the needs of their family, with single-family detached homes ranging from 2,000 to 5,000-plus square feet and prices ranging from the low $200,000s to $900,000 and higher. American Legend has sold more than 1,000 homes in the Dallas-Fort Worth market since its first closing in 2004.

[PAGEBREAK]

Fortune-Johnson Inc.

When Fortune-Johnson Inc., took on building a $60-million residential mixed-use development targeting student renters near Atlanta’s Emory University, the company compressed a 24-month construction schedule into 18 months so first-phase apartments would be available by the start of the 2012-13 school year.

A major part of the preplanning process was extensively vetting subcontractors before inviting bids, and then involving those partners in scheduling every day of the project before breaking ground. Having apartments available for rent before the start of the school year was critical for achieving high occupancy. That sort of preparation also helped the Norcross, Ga.-based company deliver on customer satisfaction and grab repeat business. The approach also complements Fortune-Johnson’s practice of cultivating and maintaining long-term cooperative relationships with clients and employees.

“Through the recession, we maintained a commitment to our strong core values, such as customer service, integrity, performance, and follow-through, and supporting our greatest asset, our people,” said Brett Fortune, principal and CEO. “Fortune-Johnson is a teamwork-based, customer-first company whose goal is to be our clients’ preferred contractor. Repeat business remains the mainstay of our growth.”

The 22-year-old company saw 2012 revenue grow 107 percent from the previous year to $192 million off the closing of 1,657 units. Fortune-Johnson expects revenue to grow about 10 percent as the multifamily industry thrives and Millennials continue to prefer renting over homeownership.

Internally, Fortune-Johnson uses several programs to meet and exceed customers’ expectations. The training program TEAM—Training Everyone Absolutely Matters—was compiled from more than 20 years of building experience and defines company procedures and expectations to new employees. A quality assurance program reinforces the company’s mantra, “Do it right the first time,” and ensures that a standard of excellence is consistently achieved.

Fortune-Johnson has built more than 15,000 units across the Southeast and Mid-Atlantic states. Projects range from garden-style dwellings to complex, high-density mixed-use developments including apartments, student housing, and retirement communities.

[PAGEBREAK]

Summit Custom Homes

Fred Delibero recognized Summit Custom Homes had to zig when other builders zagged. Not that there was much competitive activity happening in the Kansas City market during 2008, but the founder, president, and CEO of the Lee’s Summit, Mo.-based company knew he couldn’t just wait for business to come knocking at his door. So Delibero scrapped all of Summit Custom’s home plans and introduced a new line of two-story homes that not only were more efficient to build, but also offered open floor plans that were in line with consumer preferences.

“We focused on only two-story plans because, unlike ranch plans and main-floor master plans typically bought by empty nesters or more established families with older children in the house, two-story homes were appealing to a more fluid buyer who is in the market more often because of job transfers, marriages, the birth of a child, or a job promotion,” said Delibero.

But there was more than one battlefront to conquer. Summit also focused on solidifying its lending relationships and secured the capital it needed to expand into a new playing field with far fewer competitors. With new capital and floor plans in hand, company managers wanted to put icing on the cake. In late 2008, the company introduced its Green Build Advantage program, offering home buyers more energy-efficient homes with cleaner indoor-air quality, increased comfort, and a home constructed with sustainable building practices.

“Nobody was building energy efficient homes in the market at that time, and we came on strong certifying homes to meet the ANSI Green Building Standard at the silver level, and each home we built was Energy Star certified,” said Delibero.

Altogether, it was a recipe for success. Last year, Summit generated $36 million in revenue with 112 closings, up from $24 million and 77 closings in 2011. The builder is poised to hit $70 million and close more than 200 homes this year, a far cry from the mere 29 properties the company closed in 2008.

Continuing the zig-while-others-zag playbook, Summit doubled its marketing budget while competitors cut back. The company bought print media ads at the fraction of the cost publishers charged when the housing market was on fire. Summit also went heavy on direct mail marketing, fine-tuned its sales processes, redesigned the website, and bolstered relationships with co-op Realtors who brought in buyers. Behind the scenes, Delibero focused on hiring more talent while managers implemented new software aimed at improving production times.

Now that the recovering housing market has raised competition, Summit is taking advantage of its position as Kansas City’s most active single-family home builder in terms of permits to further grow unit volume and sales.

“We’re keenly aware that with new competitors in the market, we have to be sharper than ever before,” says Zalman Kohen, senior vice president and COO. “Focusing on further refining home plans and broadening our product offerings as buyers for ranch and main-floor master product return in stronger numbers will help us capture market share. In addition, our team is actively managing issues caused by increased demand such as sourcing skilled labor and controlling material costs increases. And we’ve focused on securing more land and lot inventory to meet our needs as we continue to grow.”

[PAGEBREAK]

DSLD Homes

DSLD began offering larger house plans that mostly disappeared from its markets in Louisiana and Mississippi after the industry bottomed out a few years ago. The J-swing product, which features a side entry, invokes a home typically handled by a custom builder; but DSLD saw an opportunity to provide unconventional value by incorporating the layout in its production housing, said managing partner Saun Sullivan.

Encompassing a living area from 1,800 to 2,600 square feet, the J-swing product ranges from $210,000 to $270,000 and includes amenities such as a fireplace, 42-inch custom cabinets, crown moulding, and a litany of perks in the master suite: double vanity, jetted tub, separate shower, and walk-in closet. DSLD introduced similar floor plans in a few of its subdivisions two or three years ago, but now offers the home package in “almost eight or nine” of them, said Sullivan, who attributes the product’s success largely to burgeoning activity and razor-thin inventory following a lengthy downturn.

“There is an increased demand because a lot of the older product is tired; there wasn’t a lot of stuff produced over the last five years,” he said. “So you’re not really competing with a 3-year-old house—you’re competing with an 8-year-old house.”

DSLD reported $198 million in revenue on 1,116 closings in 2012, up 71 percent from $115.8 million on 687 closings in 2011. The builder ventured farther south in Louisiana and entered the Thibodaux and Houma markets in the past year, but remains focused on filling holes in its current footprint—such as Lafayette, La., where it recently expanded after limited initial exposure.

Even though DSLD has enjoyed considerable growth in the last few years, Sullivan understands that quality control, sales communication, and ultimately customer satisfaction—all of which drive referrals—will keep the company afloat when the housing market takes another dive and prospective buyers must deliberate more before they make decisions.

“As the market comes back, a lot of builders are going to get some market sales where the people just have to move,” he said. “When the economy gets bad again and people have choices, that’s what’s going to separate companies that care about it from a lot of companies that don’t.”

DSLD, which adheres to a strict 42-day frame-to-finish schedule, has found it increasingly difficult to uphold that assurance amid a spreading labor shortage within the industry. “It’s definitely more a struggle now to find qualified people than it ever has,” Sullivan said. “A lot of these guys have been burned by the last six years, so their willingness to just go and do absolutely whatever to chase volume is going to be limited.”

The company has produced YouTube videos that aim to train new trades entering the business, and has sought to ensure its existing partners have the ability to “beef up” their crews when appropriate. Sullivan predicts DSLD will grow slightly less in 2013 compared with previous years because its markets did not plummet as far as Phoenix, Atlanta, and Las Vegas, and thus do not have as much ground to gain back.

“I’d much rather see slower downturns and slower upturns than being down 25 percent a year then up 25 percent a year,” he said. “That creates all sorts of logistical problems.”

[PAGEBREAK]

Century Communities

Century Communities took advantage of opportunities during the downturn to buy land at discounted rates and started amassing favorable lot positions in 2009, said Rob Francescon, co-CEO of the Greenwood Village, Colo.-based builder. Century focused specifically on acquiring finished infill lots in master-planned communities when purchasing distressed properties so that the company could “go vertical” quickly in quality locations.

“By doing that, we were able to roll those communities out starting in 2011, more in 2012, and continuing into 2013 and beyond,” Francescon said.

Century reported $132.9 million in revenue on 545 closings in 2012, up 89 percent from $70.4 million on 252 closings in 2011. The builder raised $241 million in a 144A private equity placement from institutional investors in May. “It puts us in an excellent position for future growth both inside the Colorado market and outside the market,” said Francescon, who adds Century recently extended beyond the Colorado market and entered Austin, Texas.

The margin-driven Austin market has fundamentals similar to Denver—the average home sales price is just over $250,000, for example—and boasts housing inventory of less than three months, as well as permit activity well below historical norms, Francescon said. “Even though we’re not back to a normal year in terms of permit levels, there’s still a lot of supply that didn’t get put into the market over the past five years,” he said.

Based on Century’s recent expansion and the opening of new communities, Francescon expects the company to double in size in 2013. He also predicts year-over-year growth in 2013 will be more than 70 percent, a testament to the hard work of a core team that has been together for more than five years.

“We’ve worked together through the downturn; from a systems and operational standpoint, we’ve been able to hone those internal controls so that we’re positioned for future growth,” Francescon said. “Like any builder that survived and grew during the downturn, you had to have the right internal controls; you had to have the right cost structure.”

Century’s foresight afforded the company enough time to identify shrewd deals and enough cash to purchase valuable properties from banks and builders in financial trouble. As the builder rolls out those new communities, it will incorporate product updated to meet current home buyer trends: open floor plans, higher energy efficiency, and more indoor-outdoor living.

Fresh off a $241-million private equity investment, Century now has the capital and scale necessary to satisfy its plan for future growth, Francescon said. The next step will be an initial public offering of the company’s stock, he added.

[PAGEBREAK]

CBH Homes

In an effort to better understand market conditions, CBH Homes acquired distressed properties throughout the downturn in hopes of developing them and capitalizing on their value when the housing market returned, but the strategy could not keep the company from hitting “rock bottom” in 2011, said Corey Barton, president of the Meridian, Idaho-based builder. When business stalled, Barton bought existing homes through auctions and trustee sales with the intent of flipping them for profit.

Barton did not understand why prospective buyers opted for a used house as opposed to a “shiny” new one, a consumer choice that contributed to the builder’s lack of success back then. “To us it was just a no-brainer, but we kept losing sales to some of these existing markets with foreclosures,” he said.

Although his new business venture never produced considerable yields, the process educated Barton about what buyers were seeking and what they were willing to pay for it.

What ultimately helped CBH capitalize on the upswing came down to inventory, land purchases, and its Outstanding Partner program. “We had the inventory, and we were prepared when the market came back with over 200 homes sitting, available, and ready to close,” said Ronda Conger, vice president. The builder was able to buy developed land at favorable prices in highly sought-after areas, adding to its edge in the market. At the end of 2012, CBH launched its Outstanding Partner “Get Some” Realtor co-list program, which led to an immediate 40-percent increase in sales.

CBH reported $85.3 million in revenue on 548 closings in 2012, up 92.7 percent from $44.3 million on 316 closings in 2011. The builder learned home buyers were trying to get everything they could at the lowest price possible while the market remained depressed. “The buyers at that time, especially in 2012, they were just asking for everything: closing costs, fences, landscaping,” Barton said.

As a result, CBH became more competitive by making key changes in its new product: different floor coverings (hardwood over tile), upgraded cabinets, and more windows, to name a few. The downturn had been especially hard on the Boise market and, consequently, most builders just stopped building there. The pent-up demand for new homes resulting from a dearth of supply now dictates the market, said Barton, who estimates 15-percent growth for the company in 2013 based on its attractive locations, increased competitiveness, and better communication with buyers.

CBH has been running lean for so long that Barton acknowledges the challenge of finding qualified workers and properly training them about the company’s protocol, culture, and mission. But he comprehends the importance of the task.

“By far, the people are the most critical part of our business going forward,” he said.