FEMA Moves to Improve Flood Insurance Program

The Federal Emergency Management Agency (FEMA) has released its implementation schedule for Risk Rating 2.0, part of an effort to create a National Flood Insurance Program that is more consumer-friendly and better reflects the actual risks posed to properties.

Implementation was originally slated to begin in 2020, but was pushed back to Oct. 1, 2021.

Under this framework, the new calculation will examine structure-specific factors and risks, such as distance to a flooding source, building elevation, and the cost to rebuild the home. As a result, some insurance rates will go up while others will go down.

FEMA will implement Risk Rating 2.0 in a phased approach. The first phase takes effect on Oct. 1 of this year, and the new rating method will be applied to all new policies purchased on or after that date, including for single-family and multifamily homes and commercial properties.

While the new rates will become effective for all existing policies on April 1, 2022, existing policyholders will have the option to opt into the new method after Oct. 1, 2021, in order to take advantage of any expected rate decreases.

Home builders will be able to mitigate or reduce the cost of flood insurance within the floodplain if they follow certain building practices. The National Association of Home Builders (NAHB) has requested sector-specific training materials regarding the practices that can qualify for rate credits under the new methodology. NAHB will continue to work with FEMA throughout the rollout of the program and will provide updates on nahb.org as information is released.

RELATED

- The Need for Resilient Construction Is Real. How Are Home Builders Responding?

- Current Building Patterns Could Put 802,555 Homes at Risk of Flooding by 2050

- Housing Affordability’s Biggest Threats

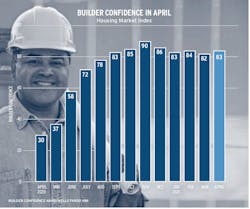

HMI shows builder confidence remained high in April

The latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI) shows builder confidence in the market for newly built single-family homes rose one point to 83 in April thanks to continued strong demand from homebuyers, even as builders struggled to contend with rising lumber prices and supply chain concerns.

Any number over 50 indicates that more builders view conditions as good rather than poor.

The NAHB/Wells Fargo HMI also gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair,” or “poor” and asks builders to rate prospective-buyer traffic as “high to very high,” “average,” or “low to very low.” The HMI index for current sales conditions increased one point to 88, and the rating for prospective-buyer traffic increased three points to 75. The component measuring sales expectations in the next six months fell two points to 81. The HMI tables can be found at nahb.org/hmi.