Innovation on the Go: How America’s Production Builders are Shaping the Future of Housing

Key Takeaways

- The housing indistry needs innovation to help overcome the affordability crisis, lack of skilled labor, and other challenges

- The largest 200+ home builders in the U.S. are integrating innovations to reduce cycle time, reducve hard costs, and gain a competitive advantage

- Advanced technologies such as building information modeling (BIM) are reducing the risk of production innovations

Despite nearly 30,000 different zoning codes and layers of building codes, significant federal, state, and local environmental and energy regulations, and on-going skilled labor challenges, the housing industry continues to figure out ways to beat the odds and innovate to build housing across the price spectrum for a growing population.

As market dynamics continue to challenge housing production, home builders not only have to figure out how to deliver a market-affordable product with reasonable profit, but also adapt to an ever-evolving regulatory landscape.

To better understand how these dynamics are shaping innovation in housing, Ivory Innovations, Pro Builder, and the Housing Innovation Alliance collaborated to include a series of questions regarding innovation in the magazine’s 2025 Top 200 survey of home builders toward their eventual ranking of by revenue.

The 213 companies that responded to the survey earlier this year represent nearly 37% of all housing starts nationwide in 2024, providing a powerful lens into the state of innovation in the industry. The survey questions we posed sought to uncover how builders define innovation, where they’re investing, and what barriers they face.

The results are clear: innovation is happening, and happening on the go.

Why Innovate?

Innovation is needed to drive down the costs of housing production. The lack of affordability has plagued the U.S. housing market for almost a decade, putting homeownership out of reach for too many households. According to the National Association of Home Builders (NAHB ), 75% of U.S. households cannot afford a median-priced new home in 2025.

Unfortunately, innovation in the homebuilding industry has lagged the rest of the economy. Data from the U.S. Bureau of Labor Statistics (BLS) shows that between 1993 and 2023, productivity increased 49% for the overall economy, while home building only increased by 15% over the same 30-year period. The need for innovation in housing, and more of it, is clear.

What is Innovation?

Based on survey results, builders’ definition of innovation varies by company, but they all share a few common themes: it must be practical, repeatable, and tied to company mission, with measurable impacts on speed, cost, quality, and sustainability.

With that, most builders agree that the best solutions should be deployed consistently across their organizations and ultimately make homes more affordable.

Another major challenge is that new construction methods or new materials (“innovation”) cannot compromise a builder’s current business model. Maintaining profitability, culture, and trust with trade partners is also important.

What Motivates Builders to Innovate?

Beyond code and regulatory changes, which require the industry to adapt to certain materials or methods, innovation in the home building industry is self-led and varies by company.

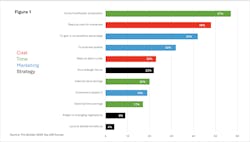

The drivers of innovation can be summed up into four (not entirely exclusive) major categories: cost, time, marketing, and strategy.

In 2024, among Pro Builder’s Top 200 home builders, faster production was the main reason for innovation (57%), followed by reducing costs for materials (48%) (Figure 1, below). Additionally, 42% of builders stated they innovate to gain competitive sales. And 22% state that it is a strategic focus for their company.

Builders weigh innovation carefully, often piloting new technologies on single homes or limited developments. Incremental changes must justify the effort of adoption, while bigger bets are made to “play ahead” of regulations and shifting consumer preferences.

Few builders want to be on the bleeding edge of innovation, but most are willing to experiment with practical, scalable solutions that align with long-term goals.

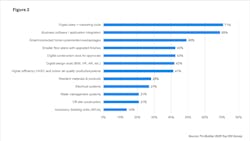

Currently, the applied innovations for the Top 200 builders focus on “low-risk” products such as marketing and sales tools (71%), business software (69%), digital design AI and virtual reality (VR) powered software (Figure 2, below).

While these innovations will continue to grow, costlier and riskier construction innovations are expected to be more widely adopted in the next five years, such as off-site construction and utilization of new materials the improve resiliency and performance.

Today, likely every home builder employs or is provided with some type of computer aided design (CAD) software to develop new product or update existing plans and elevations.

As such, the home building industry in position to take advantage of existing and new technologies such as building information modeling (BIM), VR, augmented reality (AR), and others.

These technologies can help “de-risk” costlier innovations by allowing the design team to pilot new materials and methods in a virtual environment or “modeling” before the reality of purchasing and production begin.

Challenges to Innovation

New innovations are expensive to implement and often cost more than the traditional building methods or materials. Regulatory barriers vary by jurisdiction and cause additional uncertainty. And often, innovation is thwarted by a fragmented market of literally thousands of home builders nationwide, each defining innovation—and success with innovation—differently.

There’s also often a disconnect between a builder’s pinch points and available innovations to help alleviate. Integration is another barrier, hindering a promising innovation that does not fit well into existing processes or challenges trade partners to implement. All of these barriers add additional risk to an already risky process.

For innovators and would-be disruptors, being mindful of the risk builders face is critical to success. Funding constraints remain a barrier, though home builders increasingly partner with suppliers, entrepreneurs, and public entities to share costs and risks. In addition, introducing a new product or process can jeopardize a builder’s schedules, budgets, and customer satisfaction.

Builders operate in an environment defined by tight budgets, labor shortages, and increasing regulatory demands. For production builders, profitability must be maintained even as innovation advances.

In other words, innovation occurs “on the go,” integrated into daily operations rather than as a separate initiative of balancing risk with forward-thinking change. Those who successfully align innovation with their company’s mission, culture, and measurable performance goals are best positioned to deliver homes that are more affordable, efficient, and sustainable.

Establishing strong partnerships between builders and technology developers is crucial for accelerating adoption and aligning innovations with industry needs. Collaborative efforts can bridge this gap, ensuring that new solutions are practical, scalable, and beneficial across the sector.

As the industry continues to navigate regulatory complexities and economic pressures, the ongoing integration of technology and innovative practices will be crucial in shaping the future of home construction.

About the Author

Dejan Eskic

Dejan Eskic is ithe director of research and education at Ivory Innovations and a senior research fellow at the Kem C. Gardner Policy Institute, where he is involved in housing, construction, and real estate research, fiscal impact studies, and economic and demographic analysis for key decision and policymakers.