Looking at the Interest Rate Environment

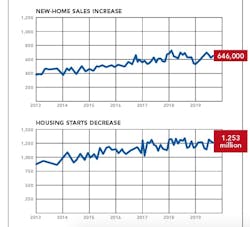

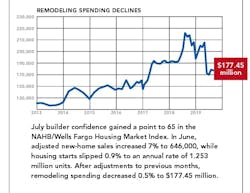

An intensified trade war with China has spooked markets and brought a notable decline in interest rates, which usually is good news for home builders. But the recent declines haven’t resulted in a corresponding increase in new residential construction.

NAHB chief economist Robert Dietz notes that home sales are not rising in response to lower mortgage interest rates because rates are falling for the wrong reasons: uncertainty related to trade and growth concerns. Dietz believes this is a good time to buy a home or finance a home improvement project. But a lack of entry-level housing remains a challenge for younger households because there are not enough housing starts to keep pace with demand.

Even though the costs of developing land, constructing a house, and buying a home are now lower, market participants are cautious because of the uncertainty that has caused rates to fall. Tariffs and trade conflicts increase the costs of new-home construction while producing regional weakness in export-dependent regions, which can hurt local housing demand. This effect has been seen in the Midwest where the trade war has weakened demand for agricultural products.

Lawmakers must advance policies that will improve housing affordability for buyers and renters. At the federal level, the recent presidential executive order on this subject was an important step. At the local level, government officials need to be aware that NIMBYism (“not in my back yard”) hurts younger households.

Housing affordability needs to be a 2020 election issue. Current credit market conditions are a reminder of the role housing plays in the business cycle. The housing industry often feels the pain first and then leads the economy out of a soft patch or recession when low rates stimulate more housing construction. The Great Recession was a notable exception to this trend.

Low rates have returned to the marketplace, but new-home construction has not yet responded in a significant way. For housing to provide a lift to the broader economy, the nation must make real progress on housing affordability.

Access a PDF of this article in Professional Builder's September 2019 digital edition

About the Author

National Association of Home Builders

The National Association of Home Builders (NAHB) is a Washington, D.C.-based trade association representing more than 140,000 members involved in home building, remodeling, multifamily construction, property management, subcontracting, design, housing finance, building product manufacturing, and other aspects of residential and light commercial construction. For more, visit nahb.org. Facebook.com/NAHBhome, Twitter.com/NAHBhome