Electrical Component Shortage Is Wreaking Havoc and Demands Action

Since late 2021, the National Association of Home Builders (NAHB) has taken the lead in sounding the alarm about a shortage of transformers and other electrical switch gear that’s fast becoming a crisis, causing construction and electrification projects to be deferred or cancelled and affecting new construction projects and repair of homes, commercial buildings, and infrastructure. The electrical component shortage also hampers the ability of electric utilities to provide reliable service to customers and to restore power after outages caused by severe storms and other natural disasters.

Last October, NAHB joined with two other construction industry groups in writing a letter to the White House and key cabinet secretaries asking the Biden administration to take action on the transformer shortage.

RELATED

- Supply Chain Solutions: 3 Tactics for Home Builders

- Republican and Democratic Lawmakers Introduce New Bill to Address Supply Chain Shortfalls

- Who Can Shorten the Supply Chain for Home Building?

More recently, NAHB, along with five other building and utility trade groups—Associated General Contractors of America (AGC), National Rural Electric Cooperative Association, American Public Power Association, Leading Builders of America, and Edison Electric Institute—sent a joint letter to leaders of the House and Senate appropriations committees urging Congress to appropriate $1 billion this year for implementation under the Defense Production Act to address this electrical component supply chain crisis.

In addition to electrical transformers, switchboards and circuit breakers are also in short supply. Orders for transformers and other switchgear that previously took two to four months to fill are now taking more than a year. Shortages of single-phase transformers and other components are preventing local jurisdictions from issuing building permits because there is no way to provide power to new homes. The problem is national in scope, but is acute in Florida due to damage from Hurricane Ian.

The ongoing shortage of electrical components is undermining the ability of U.S. businesses to build and repair housing, schools, and critical infrastructure, while also exacerbating the housing affordability crisis.

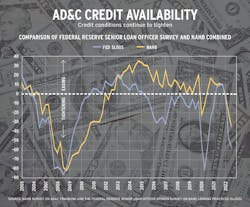

Acquisition, Development, and Construction Credit

(AD&C) credit continued to become less available and generally more costly during the third quarter of 2022, according to NAHB’s Survey on AD&C Financing. NAHB used responses from the survey to analyze credit availability, similar to the Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS). Both the NAHB and Fed indices were negative in Q3, indicating tightening credit conditions (see chart, below).

This was the third consecutive quarter during which both indices indicated tighter credit, and both have been trending progressively more negative from Q1 through Q3. The most common ways in which lenders tightened AD&C financing in Q3 were by increasing the interest rate on the loans (cited by 74% of builders and developers that reported tighter credit conditions), reducing the amount they’re willing to lend (60%), and lowering the allowable loan-to-value or loan-to-cost ratio (46%). Additional detail on current credit conditions for builders and developers is available on NAHB’s AD&C Financing Survey web page.

About the Author

National Association of Home Builders

The National Association of Home Builders (NAHB) is a Washington, D.C.-based trade association representing more than 140,000 members involved in home building, remodeling, multifamily construction, property management, subcontracting, design, housing finance, building product manufacturing, and other aspects of residential and light commercial construction. For more, visit nahb.org. Facebook.com/NAHBhome, Twitter.com/NAHBhome