President Trump Signs Tax Extenders Into Law

The bill signed by President Trump contained several temporary tax items that expired at the end of 2017. The new law extends them through 2020, and also retroactively for 2018 and 2019.

Working with Congress, NAHB pushed for the following provisions:

• A mortgage insurance deduction that gives taxpayers credit for premiums paid for private mortgage insurance and FHA/RHA/VA insurance premiums. An income cap starting at $100,000 applies.

• The Mortgage Forgiveness Tax Relief Act, which eliminates any taxes homeowners may face after renegotiating the terms of a mortgage loan that resulted in forgiveness or cancellation of all or part of the outstanding loan balance on a principal residence.

• The Section 45L new energy-efficient home credit provides a $2,000 tax credit to builders for the construction of homes that exceed heating and cooling energy standards by 50%. Builders must have tax basis in the home, meaning they must own and then sell or lease it, to claim the credit.

• The Section 25C tax credit for qualified energy-efficiency improvements provides a credit worth up to $500 for consumers to install qualified energy-efficient upgrades.

• The Section 179D commercial buildings energy-efficiency tax deduction delivers a deduction of up to $1.80 per square foot for commercial and multifamily buildings that exceed specific energy-efficiency requirements under ASHRAE 2007.

Single-Family Home Production Can't Keep Up

After record numbers of builders left the industry during the Great Recession, production has not kept pace with demand.

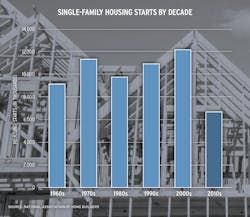

Single-family home starts of 6.8 million over the past 10 years were far lower than the numbers seen in the half century prior to the downturn and are barely half of the 12.3 million homes started during the previous decade. The figures are more striking given the U.S. population increase over the period. Also, despite adding nearly 1 million jobs to the sector since a low in 2011, overall job numbers in construction have yet to fully recover.

Years of population growth and household formations, along with reduced levels of home building, have produced a critical supply shortage. Yet surveys show homeownership remains a goal for many consumers across all segments.

NAHB studied the paradox of declining inventory, rising prices, and underperforming single-family construction over the last decade and found the lack of building is rooted in supply-side headwinds that limit construction in expanding markets. The decline is tied to challenges related to the five L’s: labor, lots/land, lumber/materials, lending, and laws/regulatory burdens.

Access a PDF of this article in Pro Builder's February 2020 digital edition

About the Author

National Association of Home Builders

The National Association of Home Builders (NAHB) is a Washington, D.C.-based trade association representing more than 140,000 members involved in home building, remodeling, multifamily construction, property management, subcontracting, design, housing finance, building product manufacturing, and other aspects of residential and light commercial construction. For more, visit nahb.org. Facebook.com/NAHBhome, Twitter.com/NAHBhome