Pro Builder 2024 Housing Forecast

If 2023 was a “wait and see” year, 2024 is lining up to be a “back to normal” affair for the housing industry, if responses to our annual Housing Forecast Survey are any indication.

Case in point: The share of builders that are optimistic about the state of the markets in which they operate rose to 63.6%, about a 10-point jump from a year ago, including a nearly 4-point increase among those that are “very optimistic.”

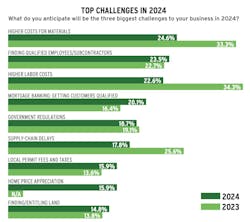

And while their top challenges for the year remain focused on higher labor and materials costs and finding qualified labor to build homes, those issues appear to be waning (along with supply-chain delays) in the face of increasingly pressing concerns and barriers, such as local permitting fees and finding and entitling land (see chart, below).

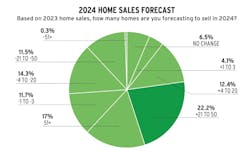

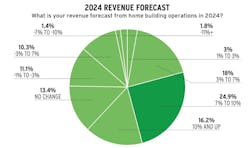

Perhaps because of that—and the nagging (if cooling) pressures of labor scarcity and inflationary hard costs—just 55.7% of builders expect to increase sales volume next year, with a commensurate impact on revenues, too (see charts below).

RELATED

- Pro Builder's 2023 Housing Forecast

- Labor-Shortage Headwinds Continue for Construction

- Builder Sentiment Is Still Down in November, but Forecast Indicates Improving Conditions

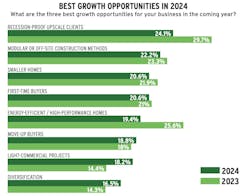

Other signs of a return to normalcy are the growth opportunities builders will turn to as a hedge against the headwinds: while “recession-proof” upscale clients remain at or near the top, interest in delivering energy-efficient or high-performance homes declined considerably (from 39.9% in 2022 to just 19.4% going into 2024), while diversification into commercial work and other non-new-home segments gained ground.

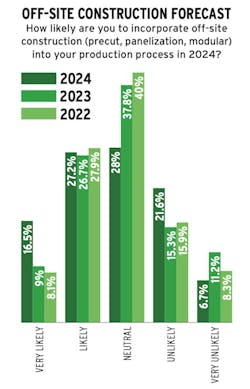

However, there was no reduction of interest in off-site construction methods. More than 22% of builders consider it a growth opportunity and 16.5% say they are very likely to incorporate some form of it in 2024, a big leap from last year (see chart, below).

Despite greater optimism about the state of their local markets in the coming year, just 55.7% of builders—primarily production operations—have forecast increasing sales in 2024, compared with their forecast of 75.3% heading into 2023.

As with sales (see top chart), fewer builders (62%) anticipate revenue growth, compared with 67% last year. Another 24.6% expect their revenues will decline, though roughly the same share are forecasting 7% to 10% revenue growth in 2024.

Challenges appear to be evening out as the industry heads into 2024. With ongoing labor and materials issues, finding land and weathering impact fees will loom larger.

Like challenges ahead, growth opportunities appear to be diversifying for 2024 as builders consider a broader range of solutions to increase revenue and profitability.

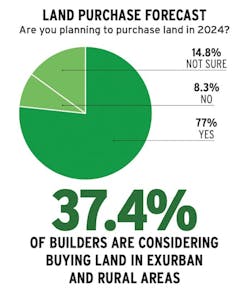

Despite availability issues, a significant share of builders say they’ll buy land in 2024 and will do so farther out from urban and suburban areas (a 15-point increase from 2023).

As the No. 2 growth opportunity (see left), off-site methods continue to gain traction, with 43.7% of builders saying they’re likely or very likely to make the switch in 2024.

METHODOLOGY AND RESPONDENT INFORMATION: The 2024 Readers’ Forecast Survey was distributed to Pro Builder print and digital audiences during September and October 2023, as well as to builder members and clients of Shinn Builder Partnerships, TrueNorth Development, Group Two, SMA Consulting, IBACOS, and the Housing Innovation Alliance. Recipients were offered the chance to win one of four $50 Visa gift cards for completing the online survey. Gift cards were awarded in November 2023. As many as 926 responses were recorded and 846 surveys completed. The source of all data shown is from the survey.

About the Author

Rich Binsacca, Head of Content

Rich Binsacca is Head of Content of Pro Builder and Custom Builder media brands. He has reported and written about all aspects of the housing industry since 1987 and most recently was editor-in-chief of Pro Builder Media. [email protected]