See Ya, Boomer! Marketing to Millennial Homebuyers

It’s official: Baby Boomers are no longer the driving force in the homebuying market. An exclusive Senex analysis of 5,000 deeds from homes purchased in 2021 and 2022 has revealed that Millennials have finally edged out their Boomer parents as the dominant players in the homebuyer market. It’s a generational changeover that has major implications for the home products industry and the way home builders are marketing to Millennials. That’s because Millennials differ from Boomers not only in their tastes and attitudes, but in terms of their wealth and spending power.

Simply put, Millennials are nowhere near as wealthy as preceding generations were at the same age. Though Millennials currently represent the largest piece of the U.S. population, they possess only a 5.6% share of the nation’s wealth according to the most recent data from the Federal Reserve. Compare that to Boomers, who at their age (in 1989) owned 21% of America's wealth.

RELATED

- Gen Zers Are Entering the Housing Market. But Where Are They Going?

- As Housing Costs Rise, Millennial Buyers Turn to ADUs

- Younger Generations Are Staying Away From the Housing Market—Here’s Why

Still, Millennials have been fortunate in recent years with regard to their spending power. Macroeconomic factors such as historically low interest rates have made homebuying comparatively easy for Millennials versus previous generations. That said, most Millennials continue to struggle with increasing living costs, the fallout of the Great Recession, and student loan debt.

Add it all up and you have a generational cohort that is significantly less well-off compared with Gen Xers and Boomers, which means Millennials' ability to purchase additional home products and/or update their homes is and will likely continue to be limited.

A Look at the Numbers

Some 12.4 million new and existing homes were sold in 2021 and 2022 combined. Of the 1.4 million newly constructed single-family homes sold, 771,000 were purchased in 2021 and 641,000 in 2022. On top of that, 11 million existing homes changed hands, 6.12 million in 2021 and another 5.03 in 2022.

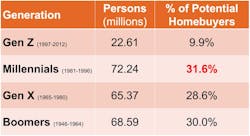

Using the segmentations created by Pew Research, the estimates of the U.S. population break down as shown in the table below.

When you subtract the under-21s (Gen Alphas) and the over-78s (Silents) from the total population, and factor out Gen Zers not yet of homebuying age, the breakdown (see table, below) shows how Millennials have overtaken Gen Xers and Boomers as the leading homebuying cohort.

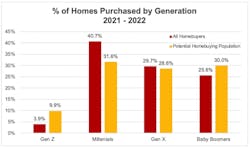

Looking at the distribution of homebuyers compared with the population of potential homebuyers shows how Millennials have been a much stronger share of home purchasers over the past two years (see graph, below).

Millennials purchased 40.7% of all homes sold in 2021 and 2022, significantly over-indexing to their share of the population. By comparison, Boomers bought 25.6% of homes, less than their share of the population.

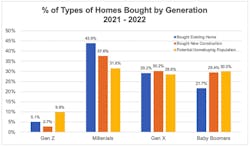

Looking at sales of new and existing homes, we see Boomers bought their representative share of newly constructed homes, whereas Millennials bought more of existing homes (see graph, below).

Marketing to Millennials: 5 Marketing Tips to Attract Millennials

With Millennials now atop the housing market, it doesn’t hurt to review our top five rules for marketing to this cohort.

1. Avoid gimmicks. Millennials have grown up with media. They can spot a gimmick mile away. The motto for talking to these folks: Get real or get lost.

2. Content, content, content. Millennials love to shop and don’t mind reading, as long as there’s a point. Especially for larger investments, they’ll want to know the “what” and the “why.”

3. Leverage websites, blogs, and social media. Digital ads work, but only if they link somewhere that’s informative and meaningful. Use ads to drive audiences to your preferred “content wells,” whether website or blog or social media platform.

4. Don’t forget conventional marketing. Ad gurus never stop touting digital for Millennial audiences, but with digital messages everywhere, conventional marketing is getting more looks, particularly in-store.

5. Make sure it matters. Millennials worry about the world. A lot. What will a purchase of one of your products do to help the world, in addition to helping the customer?

A 3-Step Strategy for Selling to Millennials

Builders and manufacturers hoping to sell homes and home products to Millennials need to take several factors into account and consider these three steps:

Step 1: Pricing. Product lines that are priced at points Millennials can afford.

Step 2: Tastes. Millennials’ tastes are high-tech, environmentally focused, and rooted in values such as social justice. Products should be designed with feature sets that speak to those preferences and sensitivities.

Step 3: Merchandising. As competition increases and margins get slimmer, it will become increasingly important to work closely with your retailers, dealers, and distributors to make sure the right mix of products makes it onto the show floor.

And while there’s a lot of information out there on the subject or marketing to Millennials, the Golden Rule for this demographic is: Be authentic. For this generation, it’s not enough to demonstrate that you have a superior product. You need show them why your brand is relevant to them.

About the Author

Bob Tancula

Bob Tancula is president at Senex, a market forecasting firm based in Louisville, KY. With over three decades of leading research and marketing teams, launched Senex to provide higher value intelligence services to businesses for less. senexglobal.com.