Special Report: Insights from the Top 200 Home Builders

This article first appeared in the May/June 2025 issue of Pro Builder.

Pro Builder’s annual Top 200 (formerly Housing Giants) survey, the basis of our rankings of the leading U.S. home builders by revenue, also garners a wealth of data about their business results, operations, concerns, and plans to weather the myriad forces that threaten production, sales, and profitability.

If anything, their insights reveal an impressive level of resilience amid almost chronic general and industry-specific economic uncertainty and upheaval since the pandemic.

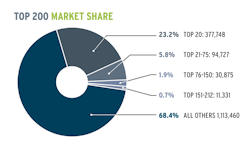

Not only did the 212 builders ranked this year earn 7.2% more revenue in 2024 than the previous year, they collectively closed or completed 7.4% more homes, accounting for nearly 32% of the overall housing market (see "Top 200 Market Share," below).

No doubt, that resilience will be tested in 2025, albeit bolstered by a healthy realism. “With tariff talks, immigration uncertainty, geopolitical tensions, persistent inflation, and mid-6% mortgage rates, the motivation to buy a home will remain lacking,” says Cynthia Keller, Senior VP of Brand | Sales & Marketing for Homes Built for America, ranked #171. “On the positive side, investment in the US will be strong, the unemployment rate remains low, and the economy overall is still doing very well.”

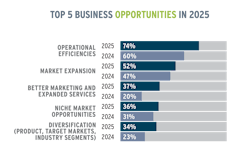

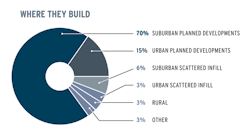

If their activity last year is any indication, Top 200 builders will continue to explore opportunities to grow, specifically in the build-to-rent (B2R) sector, while honing operational efficiencies with the help of technologies such as artificial intelligence and virtual reality tools and pursuing land and lots in suburban and urban planned developments.

B2R is especially intriguing. All told, 59 Top 200 builders completed 29,525 rental units in 2024, from detached homes to high rise apartments, an annual increase of 11.8%.

That level of production collectively earned $8.4 billion from the sale or market value of those assets, a 20% boost from 2023. And nearly one-fifth of the builders responding to our survey this year say that B2R is a business opportunity they’ll pursue this year.

"While interest rates and construction costs remain a challenge, demand for B2R housing continues due to homeownership barriers and shifting demographics,” says Jacque Petroulakis, Chief Communications Officer at NexMetro Communities, which booked all of its $1 billion-plus housing revenue in the single-family built-to-rent (SFB2R) sector in 2024, earning it a #34 ranking in the Top 200.

The Phoenix-based company is one of a growing number of new-home builders shifting at least some focus to B2R. Among the Top 200, 20 builders were new to the sector last year and another 20 increased their activity from 2023. (Of note, 13 builders also pulled out of the B2R market in 2024 after reporting activity in 2023, in part because of that sector’s vastly different revenue model.)

More charts derived from the 2025 Top 200 survey

Survey Methodology: The 2025 Top 200 Survey was distributed to Pro Builder’s print and digital subscribers between January and April 2025, resulting in a verified list of 212 companies ranked by their combined 2024 for-sale and for-rent revenue. All chart data is derived from Pro Builder’s 2025 Top 200 survey except where noted.

About the Author

Rich Binsacca, Head of Content

Rich Binsacca is Head of Content of Pro Builder and Custom Builder media brands. He has reported and written about all aspects of the housing industry since 1987 and most recently was editor-in-chief of Pro Builder Media. [email protected]