Following the rules of supply and demand, changes in home values aren’t just determined by a change in supply—prices are also affected by the number of active homebuyers searching for a home. Actually, in 20 of the 74 markets that experienced a drop in inventory, demand has fallen and so have prices.

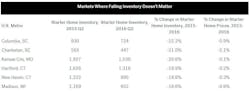

As previously mentioned, Columbia, Charleston and Kansas City are markets where the falling inventory doesn’t seem to matter. Charleston in particular has a seen a dramatic dip in home prices, with listing prices dipping 5.1 percent over the last year despite 21 percent less homes on the market.

But things aren’t always sunny on the other side of supply and demand. Correlating with the drop in inventory, the share of income needed to buy a median price starter home has increased 6 percent from 2015 at a nationally. The majority of markets are just as bad this year as they were in 2015, if not worse. Oakland, CA, Denver, CO, and San Jose, CA, top the list of markets with largest decrease in starter home affordability, and have all seen a significant increase of additional income needed to afford a starter home.

Oakland in particular is experiencing such a dramatic increase in real estate prices that the median income is struggling to keep up. As of June, Oakland homebuyers are spending 73.9 percent of the median income, which increased 8.3 percent from last year. Meanwhile, its neighbor by the Bay, San Francisco, is still seeing a consistent rise in real estate prices. The homebuyer making the median income in San Francisco would need to spend a whopping 113.6 percent of his or her income to afford a starter home.This year hasn’t brought relief to a majority of homebuyers, as affordability continues to be a struggle in competitive markets. In addition, the number of available starter homes dropped by 12.3 percent, and starter homebuyers today will spend 1.3 percent more of their income towards a home purchase nationally.

The good news is that some markets offer less competition, and with a lack of demand, real estate prices are dropping – especially markets in South Carolina. Metros in the West Coast will unfortunately continue to be a tough spot for homebuyers with high wages and high demand.

About the Author

Sam Brannan

Sam Brannan is a writer based in San Francisco. His passion for journalism, along with a familial background in real estate, sparked his interest in writing about the real estate industry. Sam writes for Trulia and other real estate sites. You can follow him on Twitter @SamBrannan.