Exclusive Research: Building Community Likes What It Sees For 2018

Confidence that the economic cycle for home building

is still on the upswing remains steady as half of

builders and architects in Professional Builder’s 2018

Market Forecast expect to sell/design more houses

next year.

Just 13.9 percent project completing fewer projects

in 2018. More than 85 percent rated 2017 as either good, very

good, or an excellent business year for their company. Those

findings track with a separate midyear survey that industry

consultant Builder Partnerships (BP) distributed to 336 home

builders asking if their actual closings numbers thus far had

changed from what they forecast at the beginning of the year.

More than 43 percent—almost all of them projecting to close

more houses than in 2017—said there was no difference between

their estimated and actual pace; 10.4 percent reported

actual closings exceeded expectations by 5 percent or less, and

20 percent saw midyear closings increase by more than 5 percent

from their original estimates.

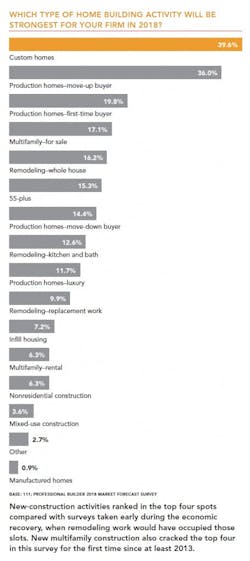

Entry-level homes ranked among the top market opportunities

for 2018, although building for first-time buyers trailed

far behind custom and production move-up clients. Move-up

homes, which have been the primary engine for the industry’s

recovery, were cited as a growth opportunity by most respondents,

followed by smaller houses. In the BP survey, just 7.4 percent

of members said they were building smaller this year; 17.8

percent were constructing larger houses, and 67.5 percent said

that their average square footage was the same as the previous

year. See the charts that follow for more survey results about

expectations for 2018.

About the Author

Mike Beirne

Mike is the senior editor of Pro Builder and Custom Builder magazines. A two-time Jesse H. Neal Award winner, Mike has nearly 30 years of journalism experience plus numerous news and feature writing awards, including honors from the Society of Professional Journalists, the American Society of Business Press Editors, and the National Association of Real Estate Editors. He also operated a masonry restoration business for more than two decades. [email protected]