Exclusive Research: The Off-Site Argument

There’s been a lot of talk lately about off-site construction as a solution to housing’s current woes, a perfect storm of skilled labor shortages, waste-laden costs, construction quality woes, lengthening cycle times, and affordability gaps that collectively cry out for better solutions.

Enter off-site, namely factory-built framing components, engineered panelization, and near-complete modules. Real-world (if controlled) studies and simple logic lead builders to believe, or at least consider, off-site’s potential for saving time, manpower, and construction waste (and related costs), even with the overhead of a factory environment.

But off-site construction has a steep uphill climb to achieve mainstream scale and deliver on those promises. The latest data from the U.S. Census Bureau say 97 percent of new homes completed in 2017 were stick-built on-site, the remainder divvied up among panelized, precut, and modular methods, among others—market shares that have remained basically stable since 1992, when Census began tracking them.

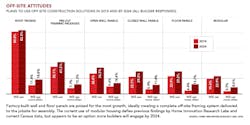

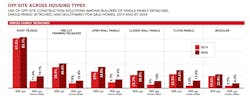

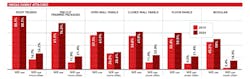

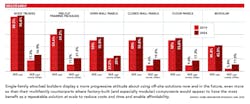

Last year, Home Innovation Research Labs conducted a two-stage survey of 300 builders nationwide to assess attitudes about off-site construction plans for 2019 and by 2024.

Not surprisingly, the results indicate the use of factory-built roof trusses (already mainstream), pre-cut framing packages, open-frame wall panels, and floor systems—the most-familiar options for a stick-building industry currently short of stick builders—are likely to gain the most traction quickly.

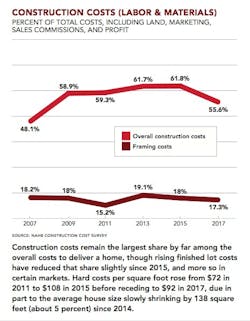

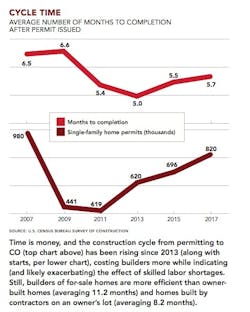

Still, Home Innovation’s annual Builder Practices Survey of about 2,500 builders saw the use of factory-built framing decline to 6.1 percent in 2017, from 8.3 percent in 2010, while stick-framing was down just 1.1 percent, signaling a slower transition. The data here tell the story of home building’s costs, cycle time, and use and shortage of subcontracted framing labor, along with Home Innovation’s recent findings.

Methodology and Respondent Information: Home Innovation Research Labs conducted special studies of 300 builders nationwide in April and December 2018. Click here for more information.

For more info on each of these data sources:

- U.S. Census Bureau Survey of Construction—Cycle Time data, Permits data

- NAHB Economics and Housing Policy Group

- NAHB Construction Cost Survey

This story originally appeared in the April 2019 issue of Pro Builder magazine. See the print version of this article here.

About the Author

Rich Binsacca, Head of Content

Rich Binsacca is Head of Content of Pro Builder and Custom Builder media brands. He has reported and written about all aspects of the housing industry since 1987 and most recently was editor-in-chief of Pro Builder Media. [email protected]