Exclusive Research: Technology Tools

Methodology and Respondent InformationThis survey was distributed between January 7 and January 16, 2014, to a random sample of Professional Builder’s print and digital readers. No incentive was offered. By closing date, a total of 232 eligible readers responded. Respondent breakdown by discipline: 23.4 percent diversified builder/remodelers; 22.9 percent custom home builders; 16.9 percent architects engaged in home building; 7.7 percent production builders for move-up buyers; 3.2 percent multifamily; 2.2 percent production builders for first-time buyers; 1.8 percent manufactured or modular builders; 1.3 percent luxury production; and 20.5 percent other businesses such as HVAC engineers, land developers, subcontractors, and consultants. Sixty percent of respondents sold one to five homes in 2013, and 13.7 percent sold more than 50 homes.

Seeing a builder on a job site retrieving blueprints with a tablet or smart phone is becoming as common as seeing a carpenter with a nail gun.

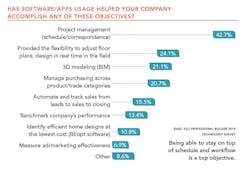

Professional Builder’s 2014 Technology Survey shows our respondents are not only using proprietary software, but are also adept with old standbys like Excel and Microsoft Office and free open-source applications when they are out in the field or in the office.

A list of the apps, software, and enterprise systems that builders are using is included with the survey results that follow:

PB