Navigating Flood-Resilience Standards Without Compromising Affordability

The Federal Emergency Management Agency met recently with members and staff of the National Association of Home Builders during the International Builders’ Show in Las Vegas to hear home builders’ perspectives on potential revisions to the minimum standards for flood-resilient construction and the Community Rating System (CRS) under the National Flood Insurance Program (NFIP).

A little background: In January 2021, the Association of State Floodplain Managers and the Natural Resources Defense Council (NRDC) filed a petition with FEMA asking the agency, among other things, to adopt higher building standards for homes and infrastructure along rivers and in coastal areas.

FEMA has responded in part by seeking more stringent building standards as well as revisions to floodplain maps. The agency has also implemented “Risk Rating 2.0,” a new NFIP pricing methodology based on flood risk. The new risk rating system, which was in development before the NRDC’s petition, has resulted in increased insurance premiums for millions of households and driven up the cost of housing for many Americans living in flood-prone areas.

RELATED

- NAHB Chairman's Message: Proposal to Create Climate Risk Committee

- What's Your Home's Flood Risk Score?

- The 'Vicious Cycle' of Property Flood Risk

At the same time, FEMA is urging communities to participate in the Community Rating System, a voluntary incentive program that encourages communities to enact and enforce floodplain management practices that exceed the minimum requirements of the NFIP in exchange for discounted flood insurance premiums for their citizens.

Of the 22,500 communities that participate in the NFIP, 1,500 participate in CRS. Communities participating in the CRS program must implement local mitigation, floodplain management, and outreach activities that exceed minimum NFIP requirements. These CRS communities provide insurance discounts to over 3.6 million policyholders, which account for more than 70% of all NFIP flood insurance policies.

The Challenge: How to Keep Housing Affordable While Addressing Flooding Issues

NAHB agrees with FEMA that it is important to avoid, minimize, and mitigate flooding effects. But NAHB also believes FEMA must do more to ensure its policies don’t push housing prices beyond the reach of low- and moderate-income households.

FEMA is looking at program alternatives that may help it attract more communities to the CRS program and has begun conducting listening sessions to collect feedback from community and industry stakeholders. Two such meetings took place during late February in conjunction with the Builders’ Show.

FEMA’s floodplain management program helps communities manage their flood risks in a sustainable way, says Nancy Niedernhofer, a senior advisor in FEMA’s floodplain management division. “We strongly believe that NFIP compliance equals resilience.” One proposal under consideration is to provide enhanced technical assistance to support communities participating in the CRS, particularly underserved communities, says Shilpa Mulik, FEMA’s CRS redesign program manager.

She noted that it is very difficult to reach underserved communities and that FEMA needs to provide more technical assistance to smaller communities to assist them with compliance. “But folks in those communities are not necessarily excited about federal experts who helicopter in and then tell them what to do,” Mulik says.

Community Rating System Program Goals

Mulik outlines the CRS program’s three overarching goals as:

• Reduce and avoid flood damage to insurable properties

• Strengthen and support the insurance aspects of the National Flood Insurance Program• Foster comprehensive floodplain management

One goal described in FEMA’s strategic plan is to achieve equitable outcomes for those we serve, Mulik says.

NAHB will continue to be fully engaged on this issue, working with FEMA to find ways to reduce flood risks to communities without sacrificing housing affordability.

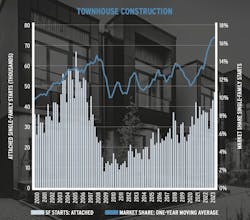

Newly Built Townhouses Reach Record-High Market Share

Townhouse construction in Q4 2023 recorded its best quarter for starts in over 17 years, with one-year moving-average market share reaching 16.7% of all single-family housing starts for the same quarter. That’s the highest market share on record for newly built townhouses based on data going back to 1985. Single-family attached housing starts totaled 47,000 in Q4 2023, up 27% from Q4 2022, and townhouses made up almost 20% of total housing starts in Q4 2023, with a total of 158,000 townhouse starts for the year.

NAHB chief economist Robert Dietz notes that while the association’s homebuyer preference surveys indicate a minority of homebuyers seek the mixed-use neighborhoods most likely to include townhomes, the data also show demand for these types of communities is strongest among younger households. In fact, more than one-third of Generation-Y households (born after 1977) seek such mixed-use residential locations.

Dietz predicts townhouse construction will continue to gain strength as more first-time homebuyers enter the market and as generational preferences shift to more walkable, medium-density locations.

About the Author

National Association of Home Builders

The National Association of Home Builders (NAHB) is a Washington, D.C.-based trade association representing more than 140,000 members involved in home building, remodeling, multifamily construction, property management, subcontracting, design, housing finance, building product manufacturing, and other aspects of residential and light commercial construction. For more, visit nahb.org. Facebook.com/NAHBhome, Twitter.com/NAHBhome