Home Building: The Numbers Tell a Story

Builder Partnerships just published its 21st consecutive home builder Financial and Operations Study. The publication is a wealth of information about the financial and operational makeup of mid-tier private home builders in the U.S. Emma Shinn, CPA, MBA, who compiles the publication’s data, says, “The numbers tell a story.” When looking at what the housing industry experienced the last seven years through the lens of the data, we see that the numbers do tell a story, and they give guidance for better decision-making in the future.

In 2006, builders were effectively hitting their target ratios of 70 percent cost of sales, 30 percent gross profit, 18 percent operating expenses, and 12 percent net profit before taxes. As the market softened in 2007, builders began to discount sales prices and offer incentives to try to maintain sales velocity. The reduced sales prices caused gross profit to drop three percentage points, which had a corresponding impact on net profit. Operating expenses did not materially change with only a minor increase in sales and marketing expenses.

Sales volumes plummeted in 2008 and 2009, and builders increased the discounting and incentives, further impacting the gross profit. That left a total loss of gross profit of 9 percentage points to 21 percent of sales revenue.

These are the factors that drove the decline in profitability in 2008 and 2009:

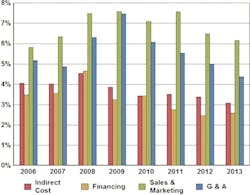

• Operating expenses ballooned to 23 and 22 percent, respectively.

• Indirect construction costs increased to more than 4.5 percent of sales revenue in 2008 and began to diminish in 2009 back to target as the builders trimmed their superintendent and field staff.

• Financing increased by more than one percentage point in 2008 as inventories escalated, and dropped back in 2009 as inventory was liquidated.

• Marketing increased to 7.5 percent of sales revenue as the builders chased sales.

• The biggest increase appeared in general and administrative (G&A) expenses, which continually increased through 2009 to almost 7.5 percent of sales as builders held on to their operational staff.

These factors resulted in net-profit declines in 2008 and 2009 to -0.75 and -1.16 percent.

A new reality

Operating expenses, 2006 through 2013

In 2010, builders began to recover and adjust their companies to the new market reality. By introducing new housing products that better reflected market demand, builders were able to reduce direct construction costs and increase their gross profits almost 3 percent. Operating expenses fell more than 2 percent, resulting in approximately 3.75 percent net profit. Builders began to adjust their office staff, realizing approximately a 1.5 percent reduction in G&A expenses. Sales and marketing decreased 0.5 percent as did the field operations.

During 2011—the worst year in history for new-home sales—builders saw a resurgence of sales and marketing expenses but were able to maintain their gross profit margins. They also continued to reduce financing expenses due to depletion of inventory and reduced G&A expenses with further staff reductions. Net profits rose to more than 4 percent as a result.

Builders continued to improve their profitability in 2012 and 2013 but fell about 4.25 percent short of their targeted profitability, while gross profit was more than 6 percent under target.

The concern now is whether the net profit being realized is sustainable. Field and office expenses are below target, revealing probable understaffing. Financing expenses will increase with expanded inventory levels and interest-rate increases. The effects of the housing recession are still being felt within home building companies, which may not be positioned to take advantage of the growing market. To maintain the current profitability, we recommend builders work on their cost of sales and especially direct construction costs to improve gross profits.

Going forward

Comparative performance, 2006 through 2013

One of the lessons from the housing recession was that builders need to act quickly to adjust to the new market. Here are seven things you can do today to control cost of sales and direct construction costs:

• Design and specify homes for a specific market, not generic

• Value engineer the structure and material usage

• Question engineers’ and truss designers’ design

• Improve estimating and purchasing

• Conduct variance analysis and control

• Conduct an “as built audit” to verify material quantities

• Talk to the trades

To obtain a copy of the Financial and Operations Study, please visit www.builderpartnerships.com. PB

For over 45 years, Charles (Chuck) C. Shinn, Jr., PhD, has been dedicated to improving the management standards and profitability of the home building industry. He can be reached at [email protected].