Working to Improve Access to Affordable Housing

While the National Association of Home Builders (NAHB) commends the Biden administration’s effort to address affordable housing, its plan puts too much emphasis on government solutions and nonprofit organizations at the expense of private enterprise.

The White House plan to address the affordable housing crisis seeks to:

• Leverage existing federal funds to spur action that reduces exclusionary zoning.

• Increase the supply of manufactured housing and two- to four-unit properties by expanding financing through Freddie Mac.

• Expand affordable rental supply by raising Fannie Mae’s and Freddie Mac’s equity cap for the Low-Income Housing Tax Credit and relaunching the partnership between the Department of Treasury’s Federal Financing Bank and the Department of Housing and Urban Development’s (HUD) Risk Sharing Program so state housing finance agencies can provide low-cost capital for affordable housing development.

• Make more single-family homes available to individuals, families, and nonprofit organizations by limiting the sale of certain FHA-insured and HUD-owned properties to large investors.

RELATED

- Solving the Housing Affordability Crisis Requires Reshaping Public Policy

- Housing Affordability Affects Housing Choice

But these steps alone aren’t sufficient for the challenge. The Biden administration needs to address the availability of skilled labor, update the nation’s housing finance system, fix the supply chain for building materials, and reduce regulatory barriers that drive up the cost of housing and delay land development.

NAHB looks forward to working with the president and his administration to find lasting solutions for housing affordability that will enable families across the economic spectrum to find housing that meets their needs at a price they can afford.

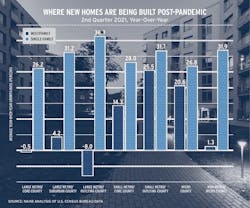

Suburban and Exurban Communities See Fastest Multifamily Growth

The COVID-19 pandemic has had a significant effect on U.S. growth patterns, particularly multifamily housing, as seen in the NAHB’s Home Building Geography Index (HBGI).

Multifamily construction posted double-digit percentage gains in small metro core and suburban areas during the second quarter of 2021, while multifamily building activity in large metro areas decreased. The HBGI shows that multifamily residential construction rose 25.5% in small metro suburban areas in Q2 2021, year over year, and 14.3% in small metro urban cores. Large metro core areas, in contrast, declined 0.5% during the same time. Core counties of metro areas experienced considerable shrinking of multifamily residential construction activity market share from 40.2% in Q1 2021 to 38.7% in Q2 2021.

The HBGI is a quarterly measurement of building conditions across the country and uses county-level information about single- and multifamily permits to gauge housing construction growth in various submarkets.

About the Author

National Association of Home Builders

The National Association of Home Builders (NAHB) is a Washington, D.C.-based trade association representing more than 140,000 members involved in home building, remodeling, multifamily construction, property management, subcontracting, design, housing finance, building product manufacturing, and other aspects of residential and light commercial construction. For more, visit nahb.org. Facebook.com/NAHBhome, Twitter.com/NAHBhome