Pro Builder 2020 Housing Forecast

If there is any pessimism about how housing will fare in 2020, it wasn’t apparent in the opinions of our readers.

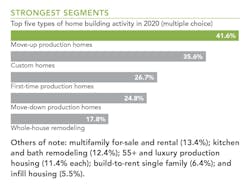

Representing a broad spectrum of the industry nationwide—led by production builders (42.8%, nearly two-thirds of which are in the move-up/move-down segment), custom builders (27%), and those diversified into remodeling (12.6%)—the results of our annual forecast survey indicate general optimism despite the specter of a mild economic or “growth” recession next year and its effect on housing production and sales.

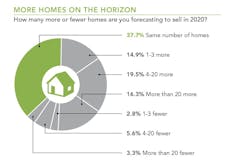

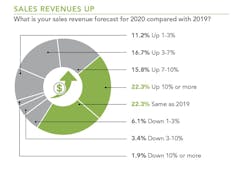

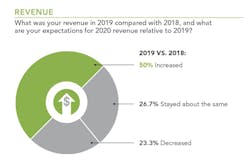

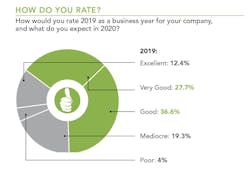

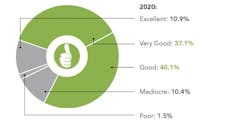

Case in point: Just 11.6% say they’ll build fewer homes next year than in 2019, while more than half plan to build more; meanwhile, 66% anticipate greater sales revenue—a third of those expecting more than a 10% bump from 2019. About half plan to buy land in 2020, relying on a diverse array of financing options. And while more than 40% are “somewhat optimistic” about their local market conditions in 2020, another 22% are very optimistic, echoing their rosy revenue forecast. Half look forward to a “very good” or even “excellent” year ahead.

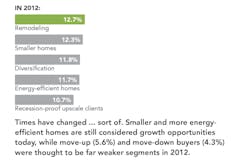

That optimism stems from a continued reliance on production (namely move-up) homes, as well as continuing strength in the custom home realm. For perspective, we also compared 2020’s top growth segments to the survey we did leading into 2012, the start of the recovery from the last recession.

Builders also see many opportunities to enable growth, from smaller, higher-performing homes to “recession proof” upscale clients and diversification into home remodeling and light commercial work, among others.

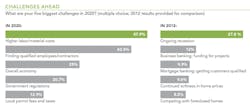

On the downside, 78% of builders anticipate prices of materials and overall bids will increase next year and they continue to face challenges for skilled labor and managing regulations and entitlement fees—barriers in stark contrast to those they were dealing with going into 2012.

Methodology and Respondent Information: The 2020 Readers’ Forecast Survey was distributed to Professional Builder’s print and digital readers between Sept. 8 and Oct. 5, 2019, as well as to builder members and clients of The Shinn Group–Builder Partnerships, Do You Convert, TrueNorth Development, SMA Consulting, IBACOS PERFORM, and the Housing Innovation Alliance. Recipients were offered the chance to win one of four $50 Visa gift cards for completing the online survey. Gift cards were awarded in mid-October 2019. As many as 215 responses were recorded and 202 surveys were completed. For additional findings, go to probuilder.com/december-2019.

[Icons for charts above: nicknik93759375 / stock.adobe.com; vektor67 / stock.adobe.com]

[Icons for revenue charts, above: kashurin / stock.adobe.com]

[Icons for How Do You Rate charts, above: tribalium81 / stock.adobe.com]

Access a PDF of this article in Professional Builder's December 2019 digital edition

About the Author

Rich Binsacca, Head of Content

Rich Binsacca is Head of Content of Pro Builder and Custom Builder media brands. He has reported and written about all aspects of the housing industry since 1987 and most recently was editor-in-chief of Pro Builder Media. [email protected]