Labor Shortage Survey: Who's Leading? Where's the Solution?

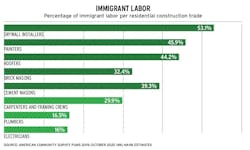

The shortage of skilled labor for housing construction, namely rough and finish carpenters and framers, but also masons, drywallers, and roofers, remains at or near the top of what keeps home builders up at night ... and largely unable to build fast enough to meet demand for new homes.

The Skilled Labor Shortage: Whose Problem? Who Has the Solution?

This is not a new problem, and the current solutions are neither easy nor a fast fix. Not only are seasoned workers aging out, but younger workers entering their earning years have been systematically steered to higher education (read: “college-for-all” policies) and the allure of careers in technology-related fields.

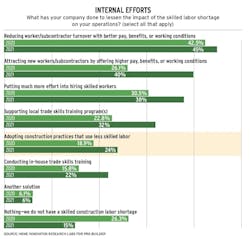

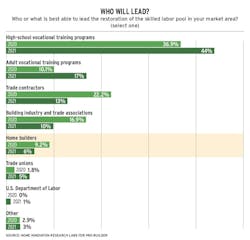

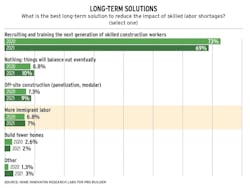

So what are builders to do? In collaboration with Home Innovation Research Labs, we asked home builders what they’ve done internally to lessen the impact of shortages; who they consider best able to lead the restoration of the skilled labor pool; and which long-term solution has the best shot of reducing the impact of the shortage.

RELATED

- Cory Kruse: After Recruiting and Hiring, Put in the Work to Keep Employees

- Building the Pipeline for Next-Gen Skilled Labor

- Off-Site Construction: A Real-World Study

The results, based on surveys conducted in late March 2020 and almost exactly a year later, reveal a stubborn reliance (and trust) in legacy recruitment and training methods, such as student and adult vocational training (and increasing support of those efforts with time and money) while using better pay and benefits to attract new workers and retain the ones they have.

The data also points to a worsening problem: In 2020, more than one-quarter of builders (26.3%) reported they were not experiencing a skilled labor shortage before the pandemic and were doing “nothing” internally to address it; a year later, only 15% said that. As a result, builders have been spreading their efforts to rectify the situation across a broader swath of actions and possible solutions, including more labor-efficient construction practices.

METHODOLOGY AND RESPONDENT INFORMATION: The data reported here is the result of three questions added to a nationwide survey deployed quarterly by Home Innovation Research Labs regarding home building activity. The first survey, issued in March 2020, resulted in 465 qualified responses; the second survey, in March 2021, garnered 303 qualified responses. Sources are noted for additional data presented.

About the Author

Rich Binsacca, Head of Content

Rich Binsacca is Head of Content of Pro Builder and Custom Builder media brands. He has reported and written about all aspects of the housing industry since 1987 and most recently was editor-in-chief of Pro Builder Media. [email protected]