2019 Housing Giants Report: Wheelin’ and Dealin’

On Dec. 3, 2018, Clayton Properties Group announced it was purchasing Mungo Homes for a reported $1.7 billion, putting an exclamation point on an unprecedented year of big-name, big-dollar mergers and acquisitions among home builders.

It was Clayton’s third M&A deal last year and its eighth since 2014, elevating the company 12 spots to No. 21 on this year’s Housing Giants list and extending its site-built footprint to 11 states.

But the real shock wave was Clayton’s purchase of a relative peer in Mungo, the then-39th-largest builder with comparable revenue and closings. The merger instantly made Clayton a top-25 player and a solid member of the billion-dollar revenue club. Not bad for a manufactured home builder.

The deal followed a remarkable run of M&As last year, from CalAtlantic’s purchase of Candlelight Homes in January (followed a month later by Lennar’s merger with CalAtlantic, combining the then-No. 2 and No. 5-ranked builders in the country) to deals by the likes of M/I Homes, AV Homes, Green Brick Partners, Century Communities, Taylor Morrison, KB Home, Beazer Homes, LGI Homes, and D.R. Horton.

Foreign Companies Making Inroads in U.S. Home Building

And let’s not forget the foreign influx: The U.S. subsidiary of Misawa Homes Co., of Japan purchased a majority share of Dallas-based Impression Homes hot on the heels of deals between Japan’s Sumitomo Forestry America and Dan Ryan Builders, and Canada’s Empire Communities’ takeover of Texas builder Centerra Homes.

But experts say these deals didn’t occur in a vacuum. “There’s often a lot of M&A activity when the [housing] market is peaking,” says Jody Kahn, SVP of research at John Burns Real Estate Consulting. Kahn tracked 21 separate M&A deals in home building in 2018, the most since 1998 and a relatively significant ramp-up from 13 in 2017 and eight in 2016. “It feels right on target with its timing,” she says.

M&As have cooled since, as if the Clayton-Mungo deal was the explosion that extinguished the fire, but there’s still a bit of smoke. “At the end of last year, you could feel it change a little bit,” says Bruce Robinson, a former PulteGroup executive and now a partner at Michael P. Kahn & Associates, in Palm Coast, Fla., a financial advisory firm to housing industry M&As. “There’s still a lot of interest [among buyers], but it’s very specific to needs they can’t otherwise meet.”

Their biggest need? Land. Among this year’s Housing Giants, 68 percent said land availability is the No. 1 challenge they face in 2019 (see chart, below).

Merger and Acquisition Incentives for Home Builders

Experts agree, and recent deals bear out, that the land positions of a potential M&A target, both in volume and location, are the primary motivation among buyers looking to hedge risk and maintain growth. “It’s still a good [M&A] market because no one is saying they have enough land,” Robinson says.

Other motivations are less clear or consistent, but the advancing age of the average home builder and willingness to weather another housing cycle are increasing incentives to sell. “This is a really hard business for a private home builder,” says David Rosen, founder and president of Long Grove Capital, in Chicago, who represented Raleigh, N.C.-based Wynn Homes in its acquisition by Houston-based LGI Homes last summer. “It’s getting harder to compete for financing, land, and labor.”

And while buy-side builders often tout a “cultural” fit with an acquired asset, that condition now includes the seller’s social media reputation. “One negative comment by someone with a broken doorknob can trash a 200-start builder,” says John Wagner, managing director at 1st West Mergers & Acquisitions, in Evergreen, Colo. “Surveying that aspect is now part of a buyer’s due diligence.”

The specter of an impending housing recession also made headlines in 2018, fueled by a decline in single-family starts in each of the last four months and punctuated by December’s 6.7 percent drop to an adjusted annual rate of 758,000 units.

That annual rate was still 2.8 percent higher than 2017, but coupled with the dip in permits at the end of the year, it was an especially bad omen considering the Federal Reserve’s then-plan to raise its benchmark funds interest rate.

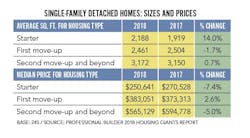

But the market’s softening at the end of 2018 was actually good for the industry, says Chuck Shinn, founder of Shinn Consulting, in Littleton, Colo. “It stopped the Fed from raising rates in 2019, so it was a reprieve for builders,” that had been discounting prices (see the Sizes and Prices chart, below) and other incentives to attract buyers in the latter half of the year.

One lingering concern for Shinn: consumer confidence. “Consumers are confident [about the economy], but aren’t spending money,” he says, pointing to declines in GDP growth in 2018 and so far in 2019. In past cycles, “The consumer is really excited about the economy … just before it crashes.”

No one’s talking about a crash on the scale of the Great Recession, of course, but experts say a softening of the housing market (tempered by stable interest rates) is likely in 2020 or 2021. “Interest rates will rise again, and builders should be cautious,” says NAHB chief economist Robert Dietz, Ph.D. “As the industry slows, builders will need to be more strategic.”

See More of Pro Builder's 2019 Housing Giants Report

- WHEELIN' AND DEALIN'—SIGNS OF A SLOWDOWN: Last year was a high-water mark for M&As among home builders, but experts say the industry is on the cusp of a slowdown

- STRETCHING OUT—DIVERSIFICATION FOR THE MIDDLE: Diversification as a way for midsize production builders to compete with their bigger brethren

- THE LIST—2019 GIANTS RANKINGS: The largest builders, ranked

Access a PDF of these articles in Professional Builder's May 2019 digital edition

Rankings and articles about Housing Giants from previous years

About the Author

Rich Binsacca, Head of Content

Rich Binsacca is Head of Content of Pro Builder and Custom Builder media brands. He has reported and written about all aspects of the housing industry since 1987 and most recently was editor-in-chief of Pro Builder Media. [email protected]