Exclusive Research: Market Intelligence

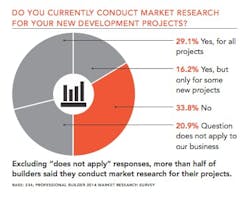

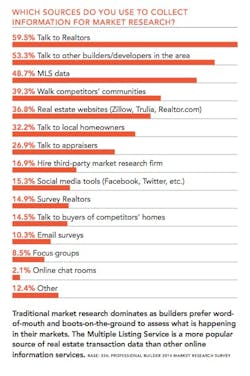

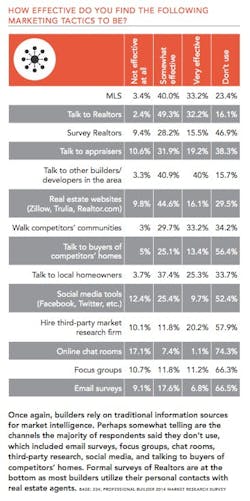

A South Carolina builder notes that new and untested markets have rendered historical data useless. This concern may explain why the majority of respondents in our Market Research Methods Survey keep their pulse on the market by tapping their personal contacts with Realtors, appraisers, and the standby Multiple Listing Service (MLS).

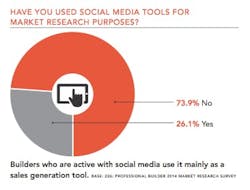

While just a fraction of respondents said they use social media for market research, one builder who does said the tool is easy to update and the information is live, “not last year.” A Tennessee builder said his company uses Facebook to track the changing habits of Millennial buyers compared with Gen X and Baby Boomers.

Methodology and Respondent InformationThis survey was distributed between Sept. 2 and Sept. 12, 2014, to a random sample of Professional Builder’s print and digital readers. No incentive was offered. By closing date, a total of 242 eligible readers completed the survey. Respondent breakdown by discipline: 22.9 percent diversified builder/remodeler; 22.9 percent custom home builder; 15.3 percent production builder for move-up/move-down buyers; 13.1 percent architect/designer engaged in home building; 4.2 percent multifamily; 3.4 percent luxury production builder; 1.3 percent production builder for first-time buyers; 2.1 percent manufactured, modular, log home, or systems builder; and 14.3 percent other. Approximately 51.6 percent of respondents sold one to five homes in 2013, and 23.3 percent sold more than 50 homes.

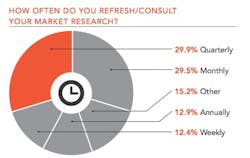

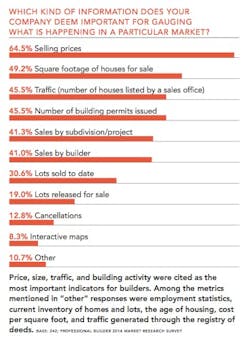

Several builders mentioned in open text comments that the market is always changing and their research must stay active or they risk falling behind. One is seeking more face-to-face time with Realtors and appraisers. Other methods that builders are using now compared with five years ago include screening job formation numbers and remodeling permits, spending more time talking to the children of buyer families, paying more attention to MLS data as resales become more competitive, and using research to compute the level of green features that can be affordably incorporated into home designs. For more results about market research method preferences, see the charts below.

PB