Market Opportunities in Building and Selling Greener Homes: Builder vs. Homebuyer Views

When I present at housing and building industry conferences, whether it’s the International Builders’ Show, Greenbuild, or the Energy & Environmental Building Alliance (EEBA) summit, and I talk about the very real market opportunity in building and selling greener homes, the response I get from builders is often one of frustration. Namely, that buyers care more about price and granite countertops than about green homes.

What Are the Differences Between What Home Builders and Homebuyers Think About and Value in Green Homes?

Which got us thinking: What are the differences between what builders and buyers think about and value in green homes? And how could that information help home builders and their suppliers understand what to do and how to communicate in a way that matches what buyers want and need—and will pay for—in green homes?

I’ll spare you the anticipation: Buyers and builders diverge, sometimes dramatically, in how they define and what they value in a green home, creating disconnects that can derail a sale. So yes, it may appear that the buyer cares more about granite than green because often what you’re building and selling to achieve green misses the mark.

Here’s what we found, what it means, and what builders that are sincere about green building can do to get back on track with prospective buyers.

Building and Selling Green Homes: The Message Matters

No matter to what level or standard you build green, the ability to sell it comes down to communication as much as construction, maybe more.

In our experience, builders are very proud (as they should be) of the extra effort and investments they make to build more resource-efficient and healthy homes. The problem is that they tend to want to talk about all of it with their prospective buyers.

You simply have to rein it in. Builders should absolutely build to the highest standards of performance and include all of the features that entails, but focus their communications efforts on the green things prospective buyers truly care about.

Buyers and builders diverge, sometimes dramatically, in how they define and what they value in a green home, creating disconnects that can derail a sale.

Here’s why: On a broad scale, 40 percent of all U.S. consumers want to be seen supporting eco-friendly products. It’s fundamental to who they are, not just a platitude, and there is no greater expression of someone’s identity than their home. It sends a message to the world about their style, their values, even their income. So, their home is the perfect way to be seen as environmentally aware and responsible.

Pay attention to the words “seen as.” Some buyers are more interested in the optics, not wanting to be seen on the wrong side of the whole environmental issue. When it comes to their homes, they’re more interested in things they and others can easily see and perceive as green: solar panels, reclaimed wood walls, and learning thermostats, to name a few. Consider that aspect in your planning and marketing.

And no matter your opinions about climate change, the reality is 82 percent of Millennial-aged parents (some of whom are now 37) describe themselves as “anxious about the impacts of climate change in their children’s lifetime.” They’re looking for ways to do their part to change the outcome and set a good example for their kids. Where better than at home?

Through our research results, we identified a group of consumers we consider to be the ripest target for green homes: people likely to buy a new home within the next two years who say a home’s energy efficiency would strongly affect their purchase decision.

We call this group the Energy Savvies.

You and the Energy Savvies: What Is This Group of Consumers Looking for in a Home?

We asked Energy Savvies what features they want in a new home among a list of items mixing green/efficient features with granite countertops, Wi-Fi-enabled sound systems, and pools. Four of their top five answers relate to resource efficiency, which is pretty encouraging.

But when we asked, “What features would have to be included in a home in order for it to be considered green?” we didn’t see clear winners. Of the 16 new-home features we listed for them, only 38 percent of Energy Savvies thought a green home must have high-efficiency HVAC, and that was the highest score of any choice (see Figure 1, below).

Ideally, we’d like to see at least 80 percent of new-home shoppers saying they “must have” two or three features to consider a home green. But since they didn’t, we concluded that Energy Savvies actually don’t know what makes one home greener than another.

That conclusion was reinforced by testing green-home terminology, namely that just 30 percent of Energy Savvies could confidently and correctly explain an “efficient home.”

And because that term and others, such as “green,” “high-performance,” “sustainable,” and “net-zero,” are well known within the housing industry, it’s more than likely many builders use those terms in their sales and marketing efforts; a tactic that can paralyze and confuse prospective buyers who can’t comprehend that language (see Figure 2, below).

Ideally, we’d like to see at least 80% of new-home shoppers saying they “must have” two or three features to consider a home green. But since they didn’t, we concluded Energy Savvies actually don’t know what makes one home greener than another.

Sadder still is that even builders report relatively little confidence that consumers are familiar with such terms, and yet many builders continue using them in marketing and sales messaging. The fix? Focus on the benefits buyers want and help them understand which features deliver those benefits. And avoid industry jargon and green speak.

Selling Green Homes: Reconnecting With Reality

To more accurately bridge that gap, builders need to reconsider the features they think define a green home and realign them with homebuyer expectations, wants, and needs.

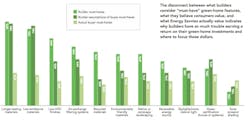

The trouble starts with a typical builder’s list of “must-have” green-home features, which is simply too long. Worse, builders often overwhelm potential buyers with that list. There’s a fundamental disconnect between what builders and buyers consider must-have green-home features. Consider certification (house or systems), which ranks fifth on the chart among buyers, but is 15th out of 16 options among builders (see Figure 1, above).

How confusing and disheartening it must be to a buyer who ranks certification so high (it’s visible and it gives them confidence in their purchase decision), only to learn that a builder places little to no value on it.

For further insight into what Energy Savvy homebuyers value, ask them what investments they’ve made to “upgrade” their current or previous home to save energy. Energy Savvies have added about five “green” features to a previous home, including LED light bulbs, Energy Star–certified appliances or electronics, and caulking or weatherstripping around windows and doors.

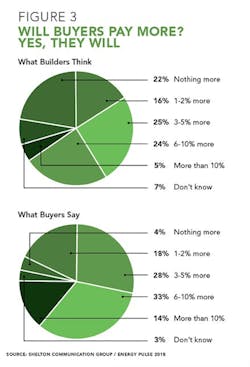

Our research found that builders underestimate the premium buyers will pay for green homes.

In my travels, I also hear builders complain that buyers aren’t willing to pay extra for green homes or features; they want it standard, despite a builder’s investment beyond code minimum and perhaps beyond the competition.

And while green building is increasingly becoming required, either by mandate or the market (and thus “standard” across all homes), there is still a lot of room to add features and benefits that resonate with buyers and open their pocketbooks.

In fact, our research found that builders underestimate the premium buyers will pay for green homes. Nearly half of Energy Savvies say they’ll pay 6 to 10 percent extra for a green home, but almost two-thirds of builders think homebuyers won’t pay more than an additional 5 percent, and a full one-fifth believe they won’t pay anything extra at all (see Figure 3).

Even if Energy Savvies won’t really pay an extra 6 percent or more, it’s likely not as dire as builders think, especially when they address the disconnect between the green features they typically provide and what green features buyers actually want.

And if price remains a hurdle, we’ve seen green-savvy builders pitch the premium cost as a wash between a slight rise in a monthly mortgage payment and savings on the owner’s energy bills. The net result is a total monthly expense that’s about the same for a better-built, higher-performing, more comfortable, and healthier home. That’s a green feature buyers can certainly understand and appreciate.

But the real solution to all of this—the too-long list, the difference in must-haves, the green-terminology barrier, the premium-price sensitivity—is to ditch a piecemeal approach and focus on selling a comprehensive package that delivers key benefits: better quality, better comfort and health, more control, and greater peace of mind.

How to Message and Market

But that’s still not quite enough. Yes, packaging the right green features into an easy-to-understand message will resonate with homebuyers, but pure information campaigns simply don’t work. So, as you do the right things to make homes truly sustainable, your marketing and sales efforts need to underscore what buyers can see and touch, what they connect with emotionally, and what they actually care about.

Start with this: People want a quality home. They want to be perceived as smart and as doing right for the environment. They worry about the economy and spending money, and about their health. They want their home to be comfortable, quiet, and clean. Show buyers how your green homes respond to those concerns and desires and you’ll get them hooked.

It also pays to wrap your brand in a green blanket. Consumers today look for brands to lead on sustainability and to show them how to be green. In fact, 86 percent of Americans believe companies should take a stand for something beyond just making money and they are ready to reward those brands.

If it’s not sincere, forget it. But if you are committed, and for the reasons buyers care about, make sure they know it. Fully commit to building greener homes and you’ll earn homebuyers’ respect … and likely a contract.

RELATED

- Breathe Easier—Healthy Homes Go Mainstream

- Market Opportunities in Building and Selling Greener Homes: Builder vs. Homebuyer Views

- Net Zero Energy: The Ultimate Z.E.N. Home's Comfort Solution

Key Consumer Findings About Green Homes and Buying Green Homes

• Americans worry about the environment and increasingly want to be seen doing something about it.

• Fifty-five percent of people in the market for a new home say energy efficiency matters—a lot.

• Buyers may want some of the same features builders believe should be in a green home. But optics are also critical, so visible features take priority.

• Green-home and product certifications reassure buyers, especially since most don’t know what specific features or products can result in a greener, more efficient home.

• Homebuyers will pay a little more for green or efficient features, but you’ll have greater success if you bundle those features in an overarching benefit story about the home, focusing on comfort and health, and communicate that story in an emotionally engaging way.

• Buyers respect companies that position themselves as standing for sustainability. That way they know your homes deliver on that value proposition and, as a result, they’ll seek you out.

Who Are the Energy Savvies?

Through our research results, we identified a group of consumers we consider to be the ripest target for green homes: people likely to buy a new home within the next two years who say a home’s energy efficiency would strongly affect their purchase decision.

We call this group the Energy Savvies, and we drew much of the data and many of the conclusions presented here from their responses.

It’s interesting to note that Energy Savvies look remarkably similar in their demographics and attitudes about the environment to those who have already purchased a certified green home. Both are more likely to be college graduates or professionals, 25 to 44 years old, have kids, lean liberal, and currently live in an urban area.

The main exception to that similarity? Money.

Money is much more of a motivator for Energy Savvies, who have an annual household income that’s perhaps 25 percent less than their green-homeowning counterparts.

As such, saving money is their top reason to participate in energy-conservation activities or buy energy-efficient products or services. That’s very different from the reason given by people already living in green homes, which is “to preserve the quality of life for future generations.”

Survey Methodology

Data collection for this research effort began on the consumer side with Shelton Group’s 13th annual Energy Pulse study, a national exploration of consumer perceptions and behaviors about energy and the environment. It included questions designed to discover what consumers actually think and know about green homes and what they’re willing to pay for them.

This year’s survey was released nationwide in August 2018 and received a total of 2,009 responses. The stratified sampling mirrored the U.S. population, reflected quotas for geography, age, gender, education, and race, and the data were weighted slightly to match U.S. population distribution.

To capture builders’ perceptions, the Shelton Group worked with Pro Builder and the Energy & Environmental Building Alliance (EEBA) to develop an online survey that included questions designed to parallel some key elements of the Energy Pulse study. That survey was released to the magazine’s readership and EEBA members in September 2018, with nearly 100 responses.

Both lists were screened for single- versus multifamily home builders, and for California versus non-California builders, given the important differences in building codes and other regulatory requirements for those housing types and jurisdictions.

Suzanne Shelton is the founder and CEO of Shelton Group, in Knoxville, Tenn., a marketing firm focused on housing sustainability and energy issues.