Building Materials Prices Fell in September, but Concrete Is on the Rise

Prices for building materials like softwood lumber and steel mill products fell for the third consecutive month in September, but costs for ready-mix concrete continue to rise at a rapid pace, according to NAHB’s latest Producer Price Index (PPI) report.

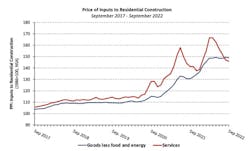

Building materials prices have fallen 2.3% since June, the largest three-month drop recorded since April 2020, but September’s modest declines follow months of price volatility throughout the COVID-19 pandemic.

The PPI for softwood lumber (seasonally adjusted) dropped 2.9% in September after falling 5.2% in August, and while softwood lumber prices are up 14.5% year-over-year, they have fallen 39.6% since March. The index remains 41.9% above pre-pandemic levels after peaking above $1,600 per 1,000 board feet in May 2021.

Steel mill products have fallen 16.1% over the last four months following a 6.7% decline in September, and though the index is at its lowest level since June 2021, prices of steel mill products are nearly double their average pre-pandemic levels, NAHB reports.

While softwood lumber and steel mill products prices are decreasing, the PPI for ready-mix concrete (RMC) rose 1.4% in September for the sixth consecutive month. The index is up 11.6% year-over-year and has climbed 8.9% year-to-date, marking the largest September YTD increase in the RMC data's 34-year history.

The most recent monthly RMC price increase was most prevalent in the South region, where prices rose by 2.6% in September. RMC prices also rose 0.3% in the West but fell 0.7% in the Northeast and were flat in the Midwest, the September PPI report revealed.

Prices for gypsum building materials have risen 20.2% over the past year and are up 46.0% since January 2020, but the September PPI revealed a slight 0.2% decline, the second monthly decrease posted in two years.

Even as single-family construction cools, prices for in-demand building materials remain elevated as a result of lingering supply chain disruptions, but a housing reset could slow price growth in the months ahead if consumer demand continues to fall, NAHB says.