NAHB and Trump Working to Reopen the Country

As the nation prepares to reopen from state and local stay-at-home orders in response to the coronavirus pandemic, the National Association of Home Builders is working with the Trump administration to make the transition as safe, productive, and orderly as possible.

NAHB CEO Jerry Howard is one of some 200 American industrial leaders chosen to be part of President Trump’s Great American Economic Revival Industry Groups, which are charged with working together to chart the path forward. In support of that goal, NAHB delivered a broad range of policy proposals designed to help the housing industry lead the nation out of the current economic slowdown and continue as an engine of job growth and economic strength for years to come. These proposals will:

• Ensure single-family and multifamily borrowers have flexibility on their forbearance repayment.

• Provide direct rental assistance and other solutions to multifamily owners to address lost rental payments.

• Advance the maximum $10,000 amount to all applicants that applied for the Small Business Administration’s (SBA) Economic Injury Disaster Loan program.

• Broaden access to the SBA’s Paycheck Protection Program to include more single-family and multifamily builders and developers.

• Ensure single-family and multifamily builders/developers, remodelers, and property owners are eligible for the Federal Reserve’s Main Street Lending Program.

Some of these proposals seek to build on existing government efforts. Flexibility on forbearance repayments is a good example. Mortgage forbearance for single-family and multifamily borrowers provides temporary relief by delaying payments, but many borrowers will struggle to immediately make up the missed payments. NAHB recommends that federal regulators provide flexibility to borrowers, such as adding missed payments to the end of their loan or extending the time period for repayment. It is also important that borrowers know their options.

RELATED

- NAHB’s Response to COVID-19, Supporting Builders

- NAHB Poll: Coronavirus’ Impact on Builders Is 'More Widespread and Severe

Steps to Strengthen the Housing Industry

Over the longer term, NAHB economists expect residential construction to lead the nation out of the deep declines that occurred when workers were asked to stay home and many businesses had to shut their doors. To strengthen the housing industry and support more housing production for years to come, NAHB proposes that the White House:

• Shift homeownership tax incentives from a deduction to a credit.

• Establish a permanent minimum 4% credit floor for the Low-Income Housing Tax Credit.

• Create a secondary market for acquisition, development and construction loans.

• Increase funding for workforce development programs

• Revise Federal Housing Administration condominium regulations to allow approvals for proposed or under-construction projects.

Details about these and other NAHB policy proposals for supporting the industry and housing production over the longer term can be found at nahb.org/coronavirus.

How Are Builders Responding to the Pandemic?

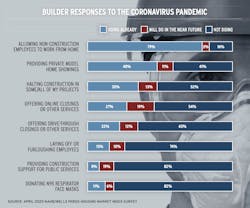

A recent NAHB survey indicates the majority of builders are implementing or planning to implement several measures that allow them to continue selling homes during the coronavirus pandemic restrictions. The most common tactic is enabling private showings of model homes (48%), but online (27%) and drive-through (22%) closings are also being offered.

In addition—and consistent with the recent decline in housing starts caused by pandemic restrictions—35% of builders say they halted construction for some or all of their projects, with another 13% considering it. So far, however, less than 25% were laying off or furloughing employees, and most (79%) had already allowed non-construction employees to work from home.

What happens with home builders in the future depends on the duration of virus-induced slowdowns or shutdowns and the effectiveness of policies to mitigate their effects (such as loans to provide needed funding to small residential construction businesses) and the number of states that classify residential construction as an essential business.

Access a PDF of this article in Pro Builder's May/June 2020 digital edition

About the Author

National Association of Home Builders

The National Association of Home Builders (NAHB) is a Washington, D.C.-based trade association representing more than 140,000 members involved in home building, remodeling, multifamily construction, property management, subcontracting, design, housing finance, building product manufacturing, and other aspects of residential and light commercial construction. For more, visit nahb.org. Facebook.com/NAHBhome, Twitter.com/NAHBhome