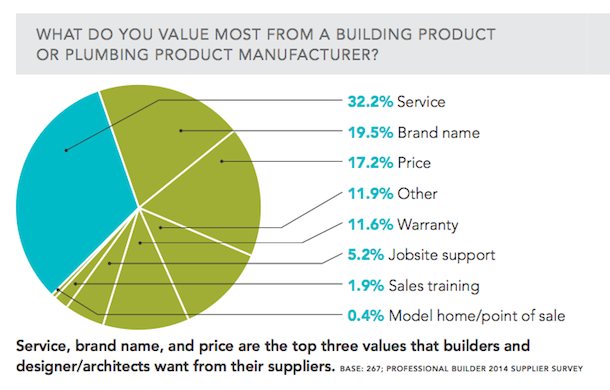

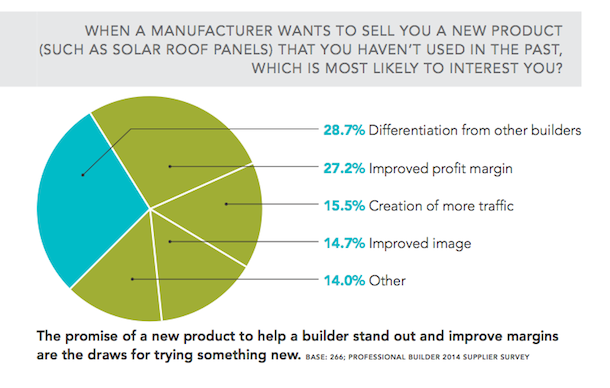

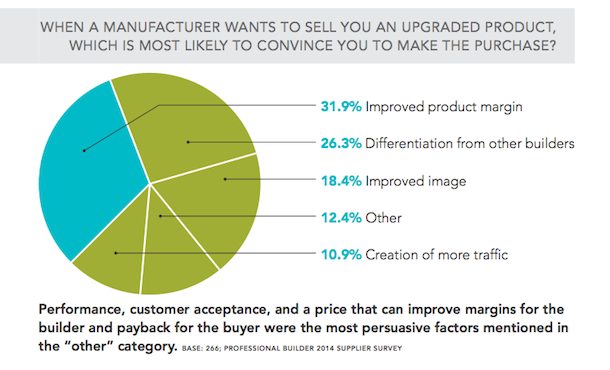

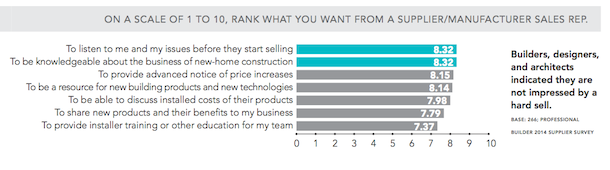

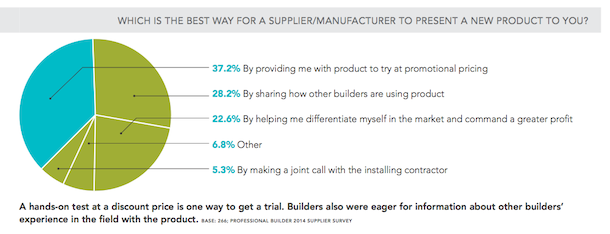

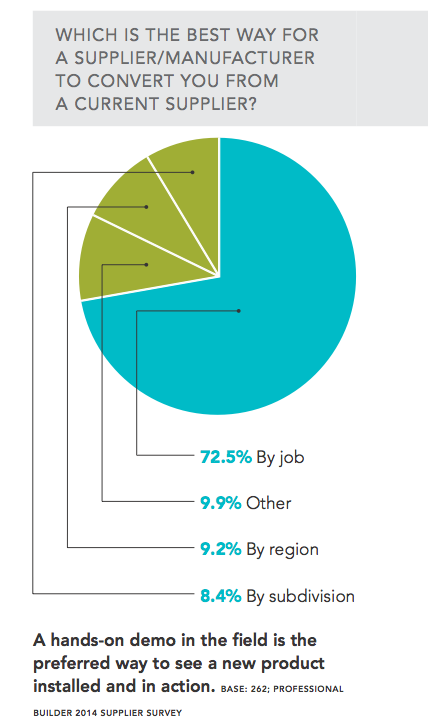

Among the key ideas that participants expressed in Professional Builder’s Supplier Survey is they want show-and-tell, real-life installation demonstrations of the new products that are being pitched to them. They also are interested in new products that can satisfy their customers’ needs while either enhancing or sustaining their own profit margins.

Methodology and Respondent InformationThis survey was distributed between July 7 and July 21, 2014, to a random sample of Professional Builder’s print and digital readers. No incentive was offered. By closing date, a total of 268 eligible readers responded. Respondent breakdown by discipline: 35.1 percent diversified builder/remodeler; 15.7 percent custom home builder; 15 percent architect/designer engaged in home building; 6.1 percent production builder for move-up/move-down buyers; 2.7 percent multifamily; 2.2 percent luxury production builder; 1.7 percent production builder for first-time buyers; 1 percent manufactured, modular, log home, or systems builder; and 20.1 percent other. Approximately 55 percent of respondents sold one to five homes in 2013, and 13.3 percent sold more than 50 homes.

Advertisement

Related Stories

Market Data + Trends

Vacation and Investment Home Market Insights

A recent report finds beach homes to be the most sought-after vacation-home type and that the investment potential of a second home is an important factor in the purchasing decision

Affordability

How Much Income Do First-Time Buyers Need to Afford the Average Home?

The median-priced home is unaffordable in 44 of the 50 largest U.S. metro areas

Affordability

What Is the Relationship Between Urban vs. Suburban Development and Affordability?

A new paper from Harvard's Joint Center looks at whether expanding the supply of suburban housing could, in turn, help make dense urban areas more affordable