It seems like a decade ago since the U.S. home building market last eclipsed the 1 million housing starts threshold. Believe it or not, it was 2007 (the industry pumped out 1.05 million units that year) — just two years removed from the industry’s all-time high-water mark of 1.72 million single-family starts.

Will the housing industry ever make it back to the glory days of seven-figure starts? Yes, but it’s going to take a few years, according to the majority of Professional Builder readers that responded to our 2011 Market Forecast survey. When asked when they believe housing starts nationally will top a million units, nearly half of builder respondents (43.86 percent) said it will occur in either 2013 or 2014. Less then one percent indicated that it will happen next year, while a whopping 34 percent said they cannot foresee the market surpassing that market ever again — that the “new normal” is below that output level (see charts below).

As could be expected, most Professional Builder reader respondents are pessimistic about the prospect of a recovery of the overall home building market in 2011. More than half of respondents (52 percent) indicated they are either “somewhat” or “very” pessimistic about a recovery in the coming year, while only a fraction of builders said they are “very” optimistic.

Despite the less-than-upbeat sentiment regarding the overall housing market, builders are generally optimistic when it comes forecasting revenue and profit for 2011. More builders than not indicated that they are planning for flat or higher revenue and profit in the coming year, with nearly a fifth of respondents (19.35 percent) projecting revenue growth of 7 percent or higher and 13.69 percent calling for profit growth of more than 7 percent next year. One frightening statistic is that nearly a fifth of builders are preparing for revenue to drop by more than 10 percent and profit to fall by more than 7 percent. Clearly, there are still plenty of builders that are preparing for the worst.

Q1. Based on your projected 2010 output, how many more/fewer homes are you forecasting to sell in 2011?

- Same number of homes 52.58%

- 1 to 3 additional homes 11.79%

- 4 to 10 additional homes 5.90%

- More than 10 additional homes 7.86%

- 1 to 3 fewer homes 15.97%

- 4 to 10 fewer homes 2.70%

- More than 10 fewer homes 3.19%

- Base: 407

About 53 percent of respondents expect to sell the same number of homes in 2011 as they’re projecting for this year, while only roughly one in five builders (21.86 percent) are planning to sell fewer homes next year.

Q2. What is your revenue forecast for 2011?

- Up 1-3 percent 11.91%

- Up 3-7 percent 6.95%

- Up 7-10 percent 7.69%

- Up more than 10 percent 11.66%

- Same as 2010 27.54%

- Down 1-3 percent 5.71%

- Down 3-7 percent 5.21%

- Down 7-10 percent 4.47%

- Down more than 10 percent 18.86%

- Base: 403

Q3. What is your profit forecast for 2011?

- Up 1-3 percent 14.18%

- Up 3-7 percent 8.07%

- Up more than 7 percent 13.69%

- Same as 2010 30.56%

- Down 1-3 percent 8.56%

- Down 3-7 percent 6.36%

- Down more than 7 percent 18.58%

- Base: 409

The lion’s share of respondents indicated that they are forecasting for flat or higher revenue and profit in 2011. One frightening statistic is that nearly a fifth of builders are preparing for revenue to drop by more than 10 percent and profit to fall by more than 7 percent.

Q4. What year do you think housing starts nationally will top 1 million units?

- 2011 0.48%

- 2012 11.62%

- 2013 22.76%

- 2014 20.10%

- 2015 10.90%

- Cannot foresee it happening. We are at a new normal below the 1 million-unit threshold. 34.14%

- Base: 413

When asked when they believe housing started nationally will top a million units, nearly half of builder respondents (43.86 percent) said some time in either 2013 or 2014. Less then one percent indicated that next year is the year, and a whopping 34 percent said they cannot foresee the market surpassing that market ever again (that the “new normal” is below that output level).

Q5. Which type of home building activity will be strongest for your firm in 2011?

- Production Homes — First-Time Buyer 8.55%

- Production Homes — Move-Up Buyer 7.41%

- Production Homes — Move-Down Buyer 4.45%

- Multi-family — For Sale 2.74%

- Multi-family — Rental 4.90%

- Custom Homes 17.45%

- Infill Housing 3.88%

- Manufactured Homes 1.60%

- Remodeling — Whole House 12.09%

- Remodeling — Replacement Work 13.00%

- Remodeling — Kitchen & Bath 11.97%

- Nonresidential Construction 5.93%

- Mixed-Use Construction 4.22%

- Other 1.82%

- Base: 877

Remodeling and custom home building seems to be the bright spots for the market heading into 2011, according to builder respondents. More than a third of builders (37.06 percent) said remodeling will be strongest for their firm next year, while 17.45 percent said the custom market will be ripe for growth. Surprisingly, less than 9 percent of respondents said they expect the market for first-time buyer product homes to be strong.

Q6. What are your top challenges heading into 2011 from a business growth perspective?

- Ongoing recession 27.78 %

- Business Banking – Funding for projects 11.97%

- Mortgage Banking – Getting customers qualified 9.86%

- Continued softness in home prices 9.55%

- Competing with foreclosed homes 8.53%

- Changing appraisals / low appraisals 6.89%

- Marketing: Finding qualified buyers and prospects 5.63%

- Government regulations 4.46%

- Competition from other Builders 4.07%

- Managing Cash 3.68%

- Local permitting fees and taxes 2.82%

- Finding qualified employees 2.66%

- Matching available lots with product that will sell 1.02%

- Other 1.10%

- Base: 1,278

Financing remains one of the biggest hurdles facing home builders during the recession, according to survey respondents. More than one in five builders (21.83 percent) identified either project financing or buyer funding as a top challenge heading into 2011 from a business growth perspective. More than 27 percent of respondents said the ongoing recession is a major obstacle to growth, while nearly 10 percent cited soft home prices as a top concern.

Q7. What are your top opportunities heading into 2011 from a business growth perspective?

- Grow remodeling offering 12.69%

- Smaller homes 12.33%

- Diversification 11.81%

- Energy-efficient homes 11.72%

- Recession-proof upscale clients 10.66%

- Light commercial projects 8.46%

- Narrower focus on specific type of project or clientele 6.78%

- Move-up buyers 5.55%

- Initiate remodeling offering 5.46%

- First-time buyers 4.49%

- Move-down buyers 4.32%

- New product technologies 3.96%

- Other 1.76%

- Base: 1,135

When ask to identify top opportunities for growth in 2011, the largest number of builder respondents (12.69 percent) pointed to the remodeling market for additional business. Other top opportunities include building smaller (12.33 percent) or energy-efficient homes (11.72 percent) to meet market demand and focuses marketing efforts on attracting clients that can afford to spend on construction projects during the recession.

Advertisement

Related Stories

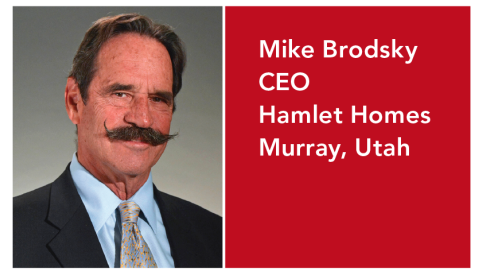

Hamlet Homes' Mike Brodsky on Finding Successors and Letting Go

A transition that involved a national executive search, an employee buyout, and Builder 20 group mentorship to save the deal

Time-Machine Lessons

We ask custom builders: If you could redo your first house or revisit the first years of running your business, what would you do differently?

Back Story: Green Gables Opens Up Every Aspect of its Design/Build Process to Clients

"You never want to get to the next phase and realize somebody's not happy."