Housing Share of GDP in Q1 2024 Rises Above 16%

The increase marks the first time GDP has surpassed 16% since 2022

Shelter Costs Drive Inflation Higher Than Expected in January

January Consumer Price Index data show inflation increased more than anticipated as shelter costs continue to rise despite Federal Reserve policy tightening

Weighing the Effects of the Fed's and Treasury's Latest Announcements

The upshot of the Jan. 31 announcements is that while mortgage rates will stay higher for longer, they're likely to hold steady

NAHB CEO Tobin Says 'Housing Renaissance' on the Horizon

Responding to positive housing-related data such as falling mortgage rates and increased homebuyer activity, NAHB's CEO Jim Tobin is optimistic

Are Fed Rate Hikes a Thing of the Past?

The Federal Reserve held rates steady again in December and forecasts three rate cuts in 2024

What's in Store for the National Housing Market in 2024

According to the 2024 National Housing Market Outlook report released on Wednesday by Bright MLS, affordability will remain the biggest challenge

Home Builders: Building and Finance

In some markets, banks are becoming more aggressive with construction loans and are even financing land development

Housing market continues to improve

While analysts continue to argue about whether or not the dip in housing sales in the first two months of 2014 is weather-related or not, it…

Declining homeownership in the United States

The boom and bust cycle of the first decade of the 21st century had an enormous effect on U.S. homeownership rates. The overall rate in the U.S.…

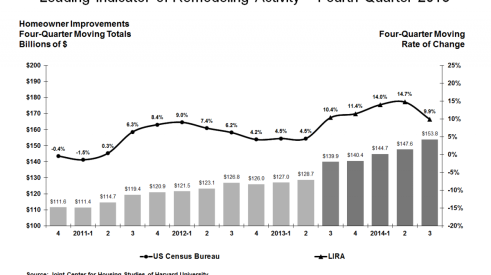

Double Digit Growth in Remodeling Spending Expected Through Mid-Year

Gains in annual home improvement spending projected for the first half of the year should moderate some to just under 10 percent by the third quarter.

Market Update: September 2013

Local HBAs tackle labor shortage; Architects see more amenities and size; CPWR snapshot of construction industry profiles an older workforce; Detroit joins the company of Turnaround Towns

Woodside raises $220 million in new funding

Woodside Homes took its “act private, look public” mantra to the next level by closing a bond offering that netted more capital for the Salt Lake City, Utah-based company than did recent IPOs for some home builders.

Builder confidence unchanged in September

Following four consecutive months of improvement, builder confidence in the market for newly built, single-family homes held unchanged in September with a reading of 58 on the Housing Market Index.

NAHB: Shortage of lots slows housing recovery

A shortage of buildable lots, especially in the most desirable locations, has emerged as one of the key factors holding back a more robust housing recovery, according to a recent survey by the National Association of Home Builders.

Higher mortgage rates prompt pause in new-home sales in July

Sales of newly built, single-family homes declined 13.4 percent to a seasonally adjusted annual rate of 394,000 units in July as higher mortgage rates prompted a temporary pause in buying activity.